Energy consumption is expected to increase by approximately 70% in emerging economies like India and China by 2030. This has raised concerns regarding energy supply, exhaustion of primary energy sources and the environmental impact of greenhouse gas emissions. The ideal solution to this problem would be to transition to low-carbon technologies to minimise the reliance on primary energy resources. Adoption of renewable energy technology would also help offset the degradation caused by greenhouse gas emissions and pave the way for policy transition to low-carbon technology. However, despite climate concerns, developing countries are generally struggling to commit to the transition from carbon-based technologies to low-carbon and renewable energy projects. Why are the business communities in these countries reluctant to invest in these technologies?

—

What Does Low-Carbon Investment Look Like?

There are three forms of low-carbon investments that are deemed feasible for developing countries.

The first form of low-carbon investment focuses on production processes that aim to reduce greenhouse gas emissions. This includes investment in energy-saving production processes, equipment and the incorporation of green construction techniques.

The second form of investment is directed towards renewable energy technologies such as solar power, wind energy and hydropower. Certain technologies are more popular in certain countries depending on the abundance of the natural resource. However, such investments are often bound by a high level of risk and uncertainty due to the intermittency of such technologies.

The third form of investment includes investment in research and development to manufacture products that help reduce greenhouse gas emissions. This includes research in processes that improve the energy efficiency of automobiles, recycling practices and waste management. These are relatively small-scale approaches that have large-scale impacts in the long run.

However, despite the possibility of several transition pathways, developing countries fail to attract domestic investment in clean energy projects. This is because entrepreneurs are reluctant to invest in clean energy technologies due to the challenges that accompany such projects.

Financing

The main concern with clean energy projects in developing countries is the acquisition and distribution of funds to finance such projects. Since the stock and bond markets in developing countries are incapable of providing large-scale funding for such projects, firms usually rely on foreign direct investment or public funds (also called institutional finance). The reason private firms are unwilling to invest in such projects is not only due to the prerequisite of large-scale funding but also due to the degree of risk and the problem of intergenerational returns. Since renewable energy is intermittent and varies regionally, projects using renewable energy technology such as solar power or wind energy are accompanied by a high level of risk since the source of energy generation may not be available consistently. Moreover, these projects are usually long-term projects and their lifespans may in some cases exceed the lifespan of the corporation investing in it. It is often argued that investment in RE technology is accompanied by intergenerational returns not only financially but also in terms of its impact on the climate. These factors tend to demotivate private corporations from investing in such ventures, as clean energy projects have long lifespans, sometimes taking at least 10 years before they start yielding profits. Moreover, infrastructure costs tend to undermine these profits. In cases where private firms are willing to undertake the risk, there is a tendency to offset this risk by increasing investment in carbon-based technologies. This has been seen in fossil fuel and renewable energy projects in Indonesia. While investment in clean energy and low-carbon sources has increased, it accompanied by a greater increase in fossil fuel investment.

You might also like: How Green Hydrogen Can Become a Cost-Competitive Climate Solution

Figure 1. Power investment trends in Indonesia

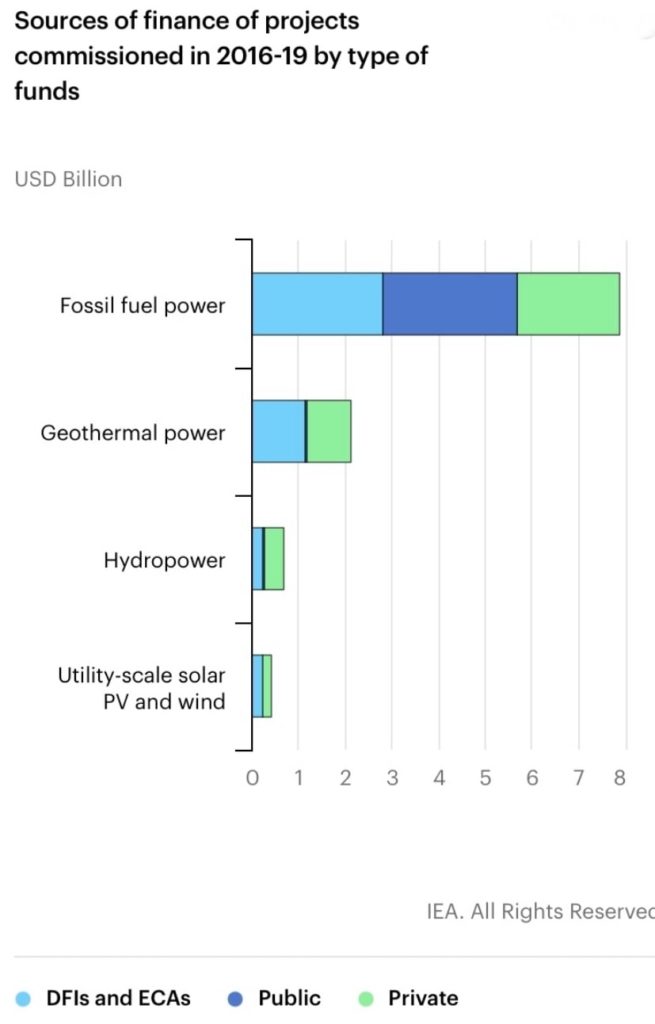

This contrast in investment in fossil fuels and renewables can be seen in public and private investments. While both public and private sectors in developing countries are inclined to invest in renewables and transition to low-carbon technologies, they often offset risky investments with relatively secure and reliable ones such as those in fossils. This can be seen even in the case of Indonesia which is rapidly moving towards clean energy supply sources (Figure 2).

Figure 2. Sources of finance for energy projects in Indonesia

Moreover, to ensure reliable supply and due to the intermittency of renewable energy sources, RE power plants are often backed up by fossil fuel plants. This could also be one of the reasons why the increase in fossil fuel investment tends to exceed that of RE investments. One of the solutions to address this problem is to adopt microfinancing or micro-lending strategies to achieve large-scale funding through small investments.

Additionally, these projects are generally steam-rolled by governments. Government-run projects in developing countries lack the efficiency and competitiveness of private corporations; consequently, these projects suffer from bureaucratic bulwarks, political corruption, delays in accessing institutional finance and several other institutional hurdles. For instance, in a bid to battle climate change, India aimed to increase solar production to 100 000 MW by 2022. However, new tax laws introduced by the government greatly demotivates investors and developers from pursuing this goal. The new tax laws increased the tax obligation of energy firms which accounted for $1.1 billion of indirect tax. While the government pledged to ensure that these taxes would be reimbursed to companies pursuing renewable energy projects, delays have resulted in only partial reimbursements.

Due to these administrative and institutional bulwarks, projects may never reach completion or may cause businesses to suffer from severe losses. Policy advocates propose that developing countries must abandon the strategy of government-run projects. Instead, they must adopt the approach adopted by EU member states wherein projects are executed in partnership with private corporations. Such partnerships see governments take on the role of a facilitator, lending institutional support and allowing access to institutional finance but allowing for the construction, design and execution of the project to be undertaken by private corporations.

Lack of Political Commitment

Political conditions are an important consideration when investment decisions have to be made. These conditions directly influence the availability and level of support available for certain projects. If the government is dominated by an emitter’s lobbying, has adopted a stance of climate scepticism or receives indirect benefits from the fossil fuel industry, then it is unlikely to support or incentivise clean energy projects.

Consider the example of Brazil. Following international outcry due to the fires in the Amazon, Brazil’s foreign minister argued that “there is no climate catastrophe” despite the region recording the highest temperatures and the most forest fires in the first nine months of 2020 in the Amazon since the 1990s. The administration’s stance of climate change denial is likely to have serious repercussions on the amount of investment in clean energy projects in the country.

In 2010, Brazil successfully embarked on the transition to low-carbon technology and by 2018 was ranked as the fourth most popular location for investment in clean energy, attracting USD$57 billion in funds. However, incumbent President Jair Bolsonaro (who came into office in January 2019) and his government’s rejection of climate science is likely to undermine this progress. Bolsonaro’s government has already revealed plans to reduce taxes on fossil fuel industries so as not “to overload the Brazilian consumer.” There has also been an increased interest in investing in fossil fuels and approval of nuclear power plant projects. This raises concerns since the nuclear energy industry often discredits renewables in its lobbying. Since Brazil is the sixth largest GHG emitter in the world, Bolsonaro’s neoclassical policies can adversely affect investment and investor’s confidence in investing in clean energy projects.

Additionally, political conditions such as corruption, bureaucracy, government transitions and administrative effectiveness will affect investor’s confidence in the regime and the prospects of clean energy projects.

The Hidden Cost Problem

The hidden cost problem can greatly impact an investor’s willingness to invest in both clean energy and carbon-based projects in developing countries. The hidden cost argument emphasises that the absence of essential infrastructure such as extended electricity grids in rural regions, transport facilities and digital connectivity can greatly increase the costs incurred on the projects. Additionally, while several developing countries have abundant manpower, there is a paucity of literate and technically trained manpower. Training and equipping employees with the skills needed to work on clean energy projects further increases costs. These increasing costs can discourage investors and can create a perception that the country hosts an inadequate support level for renewable energy projects. This is ironic because the transition to green energy makes more economic sense for developing countries especially due to the anticipated rise in energy demand.

Nonetheless, even if investors are willing to increase the amount of investment, these infrastructural inadequacies continue to hamper efficient production of clean energy since these facilities are not yet consolidated. Despite the hidden cost problem, investors could be incentivised to finance clean energy projects in developing countries through government subsidies, tax benefits and improved access to institutional finance.

Therefore, an energy transition in developing countries is a challenging task but it is not unattainable. With innovative investment strategies, multilateral grants and institutional support, the transition to renewable energy is not only possible but is in their prime interest.