Even before it was officially over, the 2020 Atlantic hurricane season was confirmed as the most active on record. With an unprecedented 30 named storms, several Atlantic and Caribbean countries were severely affected. By the end of November 2020, hurricanes in the region had created humanitarian crises across nine countries, affecting as many as 5.2 million people. As North and Central American countries brace for increasingly intense hurricane seasons in the years to come, some are exploring innovative financial mechanisms to handle the impacts of natural disasters. The policy responses developing in the region involve directly insuring natural infrastructure against natural hazards, and may become a model for other countries to implement in their environmental policy agendas.

—

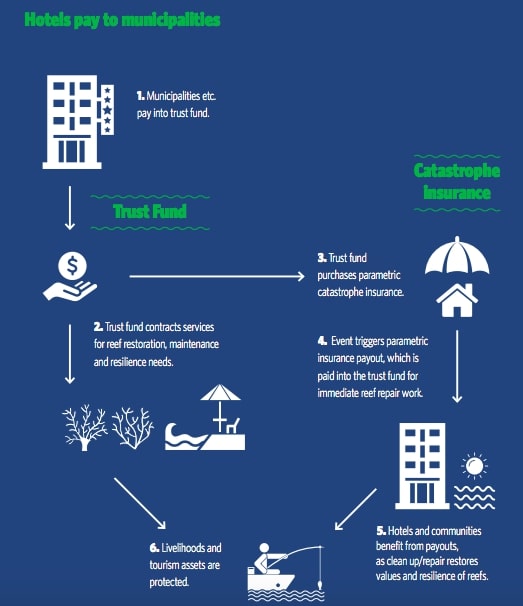

In the summer of 2019, a trust fund financed by both government and private actors in the Mexican state of Quintana Roo purchased the world’s first ever insurance policy on a natural structure for USD$3.8 million. In addition to covering 167 kilometres of coastal property, the policy also insures a section of the Mesoamerican Barrier Reef System.

The policy was the first of its kind in that natural infrastructure itself has never been directly insured against damages incurred by natural disasters. This was the first instance in which a natural structure was insured the same way that damages to a car during a road accident would be covered by insurance.

The reef was insured with a type of policy that pays out when certain specific environmental conditions are met, not when the reef itself is damaged. The insurance funds preventative maintenance and rehabilitation for the reef. The policy’s stakeholders have a shared interest in preserving the reef’s integrity, as when healthy, a coral reef can absorb up to 97% of a wave’s energy, helping protect shorelines and coastal communities from inundations, storms and flooding.

It was not long before the policy proved useful. In October 2020, Hurricane Delta struck the Quintana Roo coast. The insurance policy paid out 17 million Mexican pesos (equivalent to $800 000) to cover rehabilitation and preservation expenses of the reef and coastline.

Fast Payout, Minimal Risk and Rapid Response

The type of policy that covers Quintana Roo’s barrier reef is known as a parametric insurance policy. This policy outlines a pre-agreed upon parameter that facilitates a rapid payout as soon as a specified condition or threshold is passed; no damages need to be incurred for the policy to pay out. In the case of Quintana Roo, the insurance would be triggered when wind speeds surpassed 100 knots in the covered area, with half of the payout directed towards the reef and half towards the beaches. After this first benchmark is met, the payout gradually rises as wind speeds increase. When wind speeds exceed 160 knots per hour, the full payout is issued.

These parameters are what sets this type of policy apart from traditional insurance policies. While standard insurance policies are often triggered only when damages and financial losses are incurred, parametric policies pay out when specific conditions are met, meaning that damages or losses do not necessarily need to occur for the policy to be triggered.

This allows responsive actions to take on a more preventative nature. These parameters also tend to be incontestable and help to ensure a fast payout, allowing time-sensitive measures such as damage assessments, cleanup and preliminary repairs to be carried out swiftly. When a reef is damaged and broken corals become debris, they can die soon after settling on the ocean floor. Swift action to reattach the corals can retain the reef’s integrity.

Figure 1: Schematic of parametric insurance policy procedure; The Nature Conservancy; 2020.

The government of Quintana Roo made a strategic economic decision to insure its barrier reef rather than its coastal property. Quintana Roo is home to some of Mexico’s most highly frequented tourist destinations, such as Cancún and Tulum. The tourism industry in Quintana Roo is estimated to be worth over $9 billion. A parametric insurance policy on the barrier reef offers a fast and preventative payout while ensuring the preservation of the shore’s first line of defence against hurricanes. Traditional insurance policies would depend on damages and losses already being incurred on the shore.

To match the swift payout of the insurance policy, the Mexican government assembled teams that could rapidly respond when needed. The Reef Brigades was created as a pilot programme by Mexico’s National Parks Commission in 2018. The team is composed of tour guides, divers, park rangers, fishermen and researchers. When Delta made landfall, the Brigades was able to mobilise and be in the water within hours. The operation involved fishermen and volunteers mixing a special paste on boats above the reef, and divers ferrying the mixture underwater where they laboriously reattached damaged fragments of coral to the structure. During the first 11 days of repair, the brigades stabilised 1 200 coral colonies that had been displaced, and rescued almost 9 000 broken coral fragments.

Image 1: Reef Brigades workers reattaching broken coral fragments in Quintana Roo; The New York Times; 2020.

The insurance policy provided Quintana Roo with an important lifeline. While tourists stayed away and the local economy stalled immediately following the hurricane’s landfall, people tasked with repairing the barrier reef were able to count on the insurance money to fund their work.

Insuring the barrier reef and prioritising its protection acknowledges the reality that without it, the coastline is significantly more vulnerable, and a vulnerable coastline damages the stability of the local economy.

Mark Way, director of Global Coastal Risk and Resilience at the Nature Conservancy, said: “This is a very significant milestone in our work to explore the use of insurance as a mechanism to protect at-risk coastal ecosystems and the communities and economies that depend on nature to protect them, their property and their livelihoods. […] This is a win for nature, a win for coastal communities and will drive further interest in conservation finance and the need to protect marine ecosystems across the globe.”

Financing Nature

Concerns have emerged over the ethical quagmire of placing monetary value on natural monuments, as well as where governments choose to direct their financial support.

Studies on the commodification of nature is a growing area of environmental, economics and ethics research. Nature becomes commodified when natural structures or processes are assigned a monetary value and become exchangeable within market mechanisms. Some environmental ethicists consider the case in Quintana Roo a manifestation of the human tendency to adopt an anthropocentric perspective on environmental conservation, wherein conservation is only deemed worthwhile when humans stand to benefit.

Commodification of nature can lead to a tragedy of the commons, a situation in which individuals in a community dependent on shared resources act according to their own self-interests, depleting or spoiling the shared resource. Monetisation and privatisation of natural resources such as clean water or fertile soil can accelerate their depletion or create inequalities in terms of who is allowed to benefit from them.

The case in Quintana Roo, however, proved to be different. The insurance policy was financed by a partnership of concerned actors, including the state government, local hotel associations and a global conservation nonprofit, the Nature Conservancy. Financial support was pooled into a common trust fund. Most of the policy’s stakeholders could have opted to pursue their own independent insurance policies. For instance, a hotel could have chosen to only insure its own coastal property. By pursuing more traditional insurance arrangements, the hotel alone may reap a substantial payout in the event of hurricane damage, although would do nothing to restore the barrier reef.

A parametric insurance policy on the reef may monetise the natural structure, but also ensures that all involved stakeholders have a common interest in ecosystem preservation. A tragedy of the commons situation is avoided because no individual has an interest different from that of the collective, and all are motivated to cooperate and preserve the reef.

Speaking on the importance of using market mechanisms to protect natural resources, Fernando Secaira, a specialist on climate risk and resilience at the Nature Conservancy, said: “If we want to move the needle on how we are impacting nature, we need to move into economic terms.”

Some criticisms persist. In Quintana Roo, the government had to wait two weeks before it received the insurance payout, and another month passed before the trust fund could decide how to distribute it. Workers were assured that the money to pay for their efforts was coming, and it eventually did, but bureaucratic deficiencies may have hampered the timeliness and efficiency of response efforts.

The insurance policy also does nothing to mitigate climate change, the force that is causing more intense hurricanes in the first place, nor does it address the factors that contribute to barrier reefs’ need for restoration.

Normally, coral reefs can withstand hurricane impacts on their own without necessitating repairs. They have done so just fine for millions of years. Human activity, such as coastal pollution and overfishing, have led to the deterioration of barrier reefs’ integrity. Warmer oceans caused by climate change have also caused coral bleaching, making reefs even more vulnerable to hurricane impacts.

While the insurance policy sets aside financial resources to maintain the stability of the reef, the underlying causes behind more intense storms and reef deterioration remain unresolved. Concerns have been raised over whether the money financing the insurance policy could be better spent elsewhere. Would it be better to direct more resources towards financially supporting affected coastal communities and businesses, or even to finance initiatives that reduce Mexico’s greenhouse gas emissions?

There is no perfect answer, nor is there a solution that is universally applicable. Faced with large and complex challenges, the best approach is often to pragmatically understand where small victories can be had and focus on scaling effective solutions.

Scaling Solutions

The Nature Conservancy, which helped coordinate Quintana Roo’s parametric insurance policy, is exploring how to replicate the scheme in other areas under different environmental circumstances. These efforts are being made through partnerships with the United Nations Development Programme and international environmental and insurance groups.

The Nature Conservancy released a report assessing the feasibility of implementing parametric insurance policies in the US states of Florida and Hawaii. The report’s authors evaluated different potential natural disasters that could occur, and consequently what specific parameters would need to be implemented. In addition to hurricanes, marine heatwaves could be insured against, with a parameter set on the correlation between sea surface temperature and likelihood of coral bleaching. Stormwater runoff and flash floods caused by heavy precipitation could also be the targets of an insurance policy, tied to the parameter of precipitation rate and volume.

In addition to insuring reefs, the report also identified coastal mangrove forests as ideal natural infrastructure to protect from climate change impacts. Similar to barrier reefs, mangrove forests can reduce wave heights by up to 36% and storm surge heights by up to 75%. Research is ongoing between the Nature Conservancy and the University of California to implement parametric insurance policies for coastal mangrove forests across seven countries in the Caribbean region. Worldwide, mangrove forests are in decline. If initial research proves promising, parametric insurance policies could feature in countries such as India, Malaysia, Indonesia, Thailand, Myanmar and Papua New Guinea.

Similar ecosystems could be subsequently targeted. For instance, peat bogs are coastal wetlands that, despite covering only 3% of the world’s land area, sequester and contain around twice as much carbon as all the world’s forests combined in the form of slowly decaying vegetation. Peatlands could be insured against tropical storms and storm surges with a parameter set on the wetlands’ salinity level, or against wildfires with a payout determined by changes in air humidity levels and temperature.

Governments have also begun to investigate purchasing parametric insurance policies on their own. The California state government has tasked the California Climate Insurance Group to “identify, assess, and recommend risk transfer market mechanisms that promote investment in natural infrastructure.” The group is an assembly of lawyers, financial experts and researchers who are working to craft solutions that can insure natural structures against wildfires, floods, mudflows, urban heatwaves and sea-level rise.

Parametric insurance policies need not be limited to coastal regions and marine natural infrastructure either. A 2020 study in Switzerland surveyed public opinion and willingness towards spending public and private funds to insure forest ecosystems considering their social value. Hillside forests prevent soil erosion and act as natural buffers protecting population centres and infrastructure from rockfalls, avalanches and landslides. The study found that, when officials promoted the capacity of forests to reduce natural hazard risks, a majority of households and firms were willing to finance forest insurance services that promised better resource management. By publicising the ability of natural resources to mitigate environmental risks, individuals, businesses and governments alike can be incentivised to protect ecosystems such as forests.

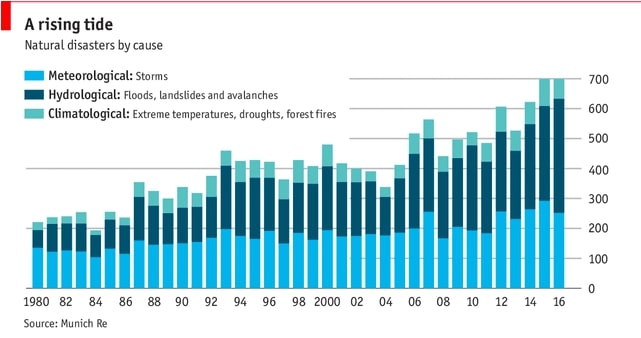

Figure 2: Increased rate of natural disaster occurrence since 1980. Policymakers need to adopt innovative measures to mitigate future physical damages and economic risks; The Economist; 2017.

Parametric insurance policies have the potential to play an important role in the efforts to conserve natural infrastructure by involving the private sector and employing existing market mechanisms. These policies are clearly not a cure-all panacea to environmental degradation, and will not be able to solve the underlying issues that are causing ecosystems to deteriorate at such an alarming rate, although they manage to spread physical and financial losses over time. Insurance is a single solution that, if scaled sufficiently to a global scale, can complement other policy measures that protect and rehabilitate essential ecosystems.

Featured image by: Flickr