The meat and dairy industries alone are driving the world to exceed critical levels of global warming and reducing emissions from energy generation down to zero alone would not be enough to compensate for it. Thankfully, the rapidly growing plant-based sector has the potential to be the lifeline the planet needs. Sales of alternative food have boomed in recent years and so have investments in startups and companies developing new environmentally friendly proteins. To celebrate Veganuary 2024, Earth.Org has put together 10 interesting plant-based food facts that will help you understand the state of the industry.

—

10 Interesting Plant-Based Food Facts

1. Oats and soy are some of the most popular ingredients used in plant-based products

Plant-based milk alternatives have become an established item on the lists of food shoppers. From soy and oat to coconut, rice, and almond milk, the selection is endless. The latter is currently leading the market and in 2021, it reached a sales value of USD$344 million. Thanks in large part to the huge success of the Swedish brand Oatly, oat milk has grown exponentially in recent years. The fact that oats are a sustainable crop that is not associated with deforestation or excessive need for water and, unlike dairy, soy, or nuts, they are inherently allergy-friendly, make them a great milk alternative.

As for plant-based foods, along with protein-rich foods such as peas, beans, and mushrooms, one of the most common ingredients used in the production of meat substitutes is soy. Soy derivatives such as tofu and tempeh are commonly found in plant-based meat because of their distinctive, meat-like texture. Since the 1950s, global soybean production has increased 15-fold, with the US, Brazil, and Argentina accounting for nearly 80% of the global soy production. While the detrimental impact of soy plantations on the environment is often the centre of heated debates – as the soaring demand for this legume leads to wide-scale deforestation, soil erosion and water contamination – many wrongly blame the plant-based industry for it. Yet, nearly 90% of the world’s soybeans are fed to farmed animals, while just 6% is turned into soy-based products for human consumption.

2. US retail sales of plant-based foods grew by 6.2% in 2021

In 2021, unprecedented demand sparked large-scale production of new plant-based meat, seafood, eggs, and dairy products, with large food companies, startups, and retailers stepping up efforts and resources to develop high-quality plant-based food.

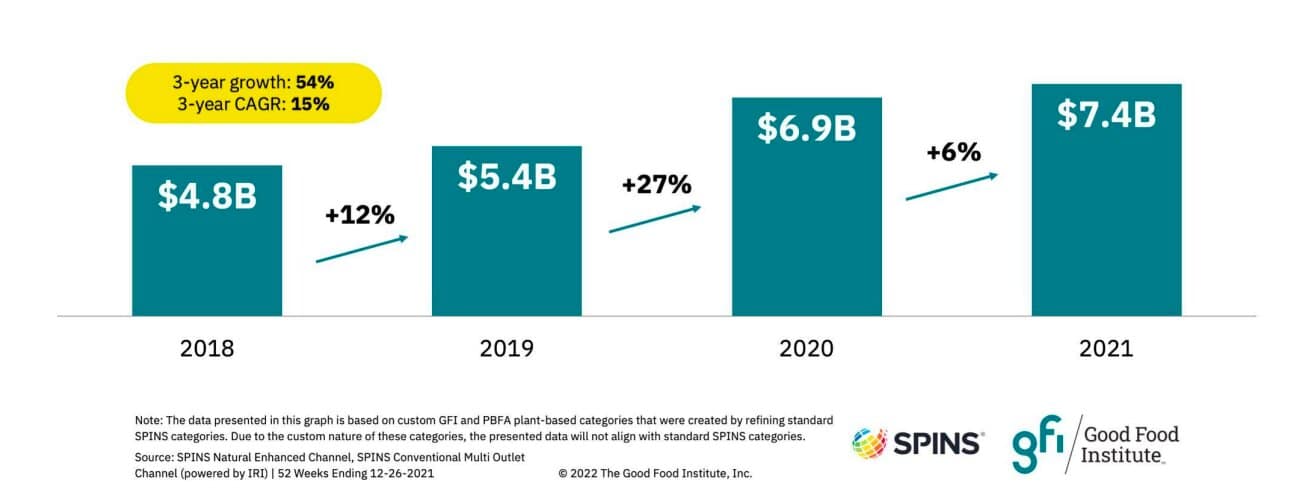

Despite pandemic-driven supply chain disruptions and the global economic crisis, 2021 sales in the US charted impressive growth for the third year in a row, increasing by 54% between 2018 and 2021. Furthermore, sales of alternative proteins outpaced their animal-based counterparts, growing three times faster than that of the total food retail sales.

3. Plant-based milk is the most developed of all alt protein categories

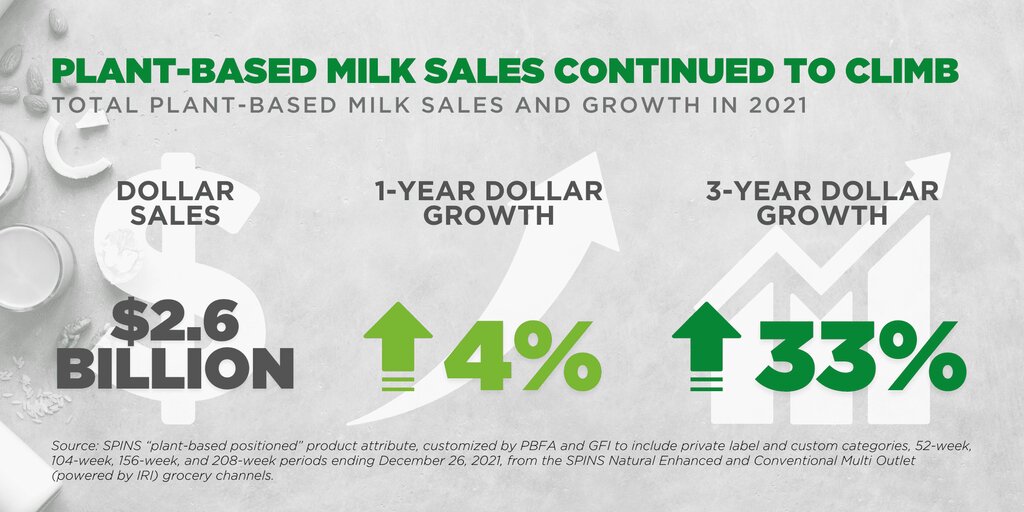

Alternative milk is by far the largest category in the plant-based market and it continues to benefit from product innovation and expanded assortment. In 2021, plant-based drinks generated USD$2.6 billion in sales in 2021 alone, a 33% growth over just three years. Its animal-based counterpart (eg. cow’s and other animal milk), by contrast, recorded a loss of USD$264 million in the same year.

Plant-based milk sales, 2021.

Plant-based eggs, which has the least diverse selection of products, was also the fastest-growing category in the plant-based market. Since 2018, alternative egg sales experienced a growth of 1,000%, reaching USD$39 million in sales in 2021. Investments into research to develop egg substitutes have also boomed in recent years, making up for a lack of offer.

4. The global plant-based foods industry could make up to 7.7% of the global protein market by 2030

If plant-based food continues to grow at the current pace, it could reach a staggering value of over USD$162 billion by the end of the decade, up from nearly USD$30 billion in 2020. According to a recent Good Food Institute report on the state of the industry, plant-based foods in the US are a USD$7.4 billion market, with alternative milk being by far the most profitable sector. Plant millk alone recorded USD$2.6 billion in sales in 2021 and it is projected to keep growing steadily in the coming years. As far as plant-based meat goes, in 2021 the US accounted for nearly half of total global sales, reaching nearly USD$5.6 billion. However, this only captures a tiny fraction of the global meat market, which has an estimated value of USD$1.7 trillion.

While the largest plant-based markets are North America and western Europe, the Asia Pacific region experienced a record 30% growth rate in 2022, by far the fastest the sector has grown globally.

Total plant-based food dollar sales, US retail, 2018-2021. Image: Good Food Institute.

5. Plant-based seafood is set to surpass alt-meat industry by 2030

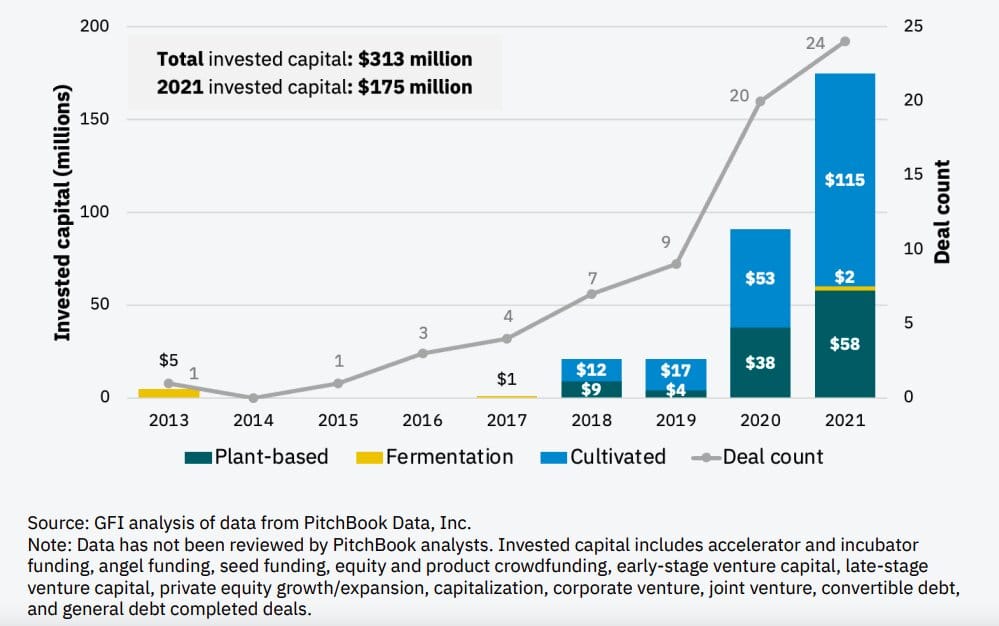

Similar to what brands like Beyond Meat and Impossible Foods have done for the meat industry, plant-based seafood companies – such as the American Good Catch and Kuleana and Hong Kong-based OmniFoods – are working on growing a new protein market. Between 2019 and 2021, sales from this sector increased by 42%. Plant-based seafood companies are increasingly prominent on investors’ radars, with millions of dollars being invested in startups and companies developing new products.

Annual investment in alternative seafood companies, 2013-2021. Image: Good Food Institute.

You Might Also Like: 5 Sustainable Plant-Based Seafood Companies Leading the Way

6. Plant-based meat production leads to 30-90% less CO2 emissions than conventional meat

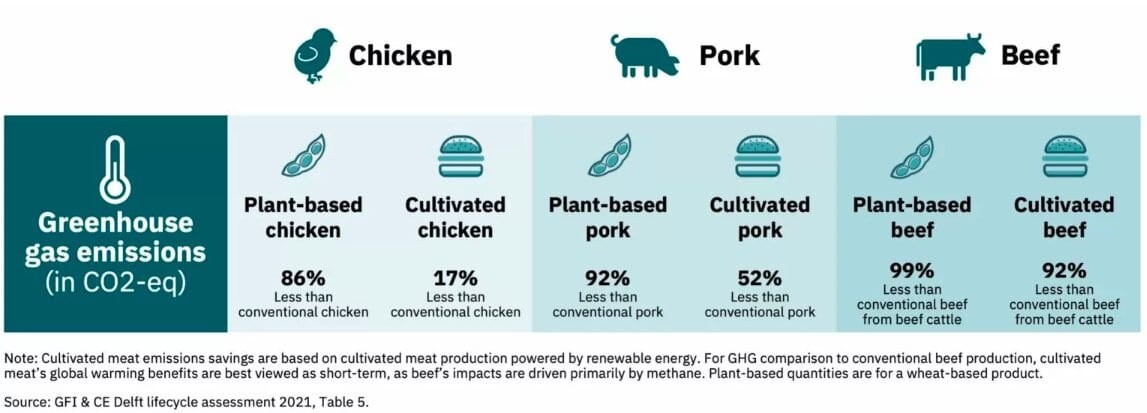

The Sixth Assessment Report by the Intergovernmental Panel on Climate Change (IPCC) delivered a clear message: we can avert global warming simply by switching from traditional to plant-based or cultivated meat as data show a remarkable difference in their environmental footprint. According to the Good Food Institute (GFI), plant-based chicken emits 86% fewer greenhouse gas emissions than its conventional counterpart, while cultivated chicken produced with renewables accounts for 17% less emissions. But beef and pork are even better. Plant-based and cultivated beef generate respectively 99% and 92% less emissions than traditional beef. As for pork, the plant-based version saves up to 92% emissions while the cultivated one has half the impact of conventional pork.

Opting for alternative proteins can also help achieve considerable methane emissions reductions. Agriculture, forestry, and land use contribute to 46% of total methane release, the largest share of any other industry. Simply swapping a conventional beef burger for a plant-based, fermentation-enabled, or cultivated alternative can result in 85% to 99% reductions in emissions.

Greenhouse gas emissions of conventional vs. plant-based and cultivated meat. Image: Good Food Institute.

7. Plant-based meat is twice as expensive per pound as conventional meat

Price is often the major barrier to plant-based meat consumption. However, given the detrimental impact of the meat industry on the environment and taking into account that meat consumption is expected to increase by 70% to 100% over 2005 levels by 2050, achieving price parity between the traditional and the plant-based industry is non-negotiable if the goal is to push more consumers to switch to alternative proteins.

A recent GFI study showed that the plant-based meat market is on the right track to reach price parity with its counterpart by 2023. Furthermore, despite data showing that plant-based meat is still twice as expensive per pound as conventional meat, the 2021 report found that the price of the latter was up 7% from the year prior, compared to just a 1% increase of plant-based meat price over the same period. The rising costs were mainly due to the fact that many slaughterhouses and meat-processing plants around the world were forced to close during the Covid-19 pandemic, and the consequential global supply chain disruptions added a further burden to the already stressed industry.

Yet, a recent academic study found that price cuts to alternative foods alone would not be enough to significantly limit global warming driven by eating meat, and further innovation in cutting emissions from cattle is needed in order to achieve net zero goals.

8. Nearly $2bn have been invested in alt protein development so far as the world explores climate solutions

In the last four years, the plant-based protein market has seen investments skyrocket amid growing interest in more sustainable alternatives and health and rising public social consciousness. Furthermore, exciting technological innovation within the market has made for a very attractive opportunity to investors. Many are now betting millions of dollars in startups and companies devoted to developing new foods and diversifying the market by exploring other plant-based alternatives to spreads and sauces as well as eggs.

For the most part, investors are looking at companies located in North America. Indeed, more than 50% of the total global fundings in 2021 – a total of nearly USD$1 billion – went to US-based businesses. Chile is second in terms of investments, with approximately USD$245 million received in the same years, followed by Australia and the UK-based companies, which got nearly USD$115 million in funding

9. There are Many controversies around plant-based products labels

With the expansion of the plant-based market, the debate over product labelling has gotten more heated. Several US states such as Louisiana, Oklahoma, Arkansas, Missouri passed label censorship bills to restrict the use of terms such as ‘meat’, ‘beef’, or ‘chicken’. In May 2021, the European Parliament withdrew a controversial legislative amendment that would have severely restricted the use of dairy-related terms like ‘buttery’ and ‘creamy’ on plant-based products after nearly half a million people as well as more than 100 organisations – including Greenpeace and the World Wildlife Fund (WWF) – signed a public petition to overturn the policy. Despite that, countries like Belgium and France managed to introduce restrictions on labelling of plant-based seafood and meat products.

10. Beyond Meat and Oatly Are Leading the Plant-Based Market

The American-based Impossible Foods and Beyond Meat are indisputable leaders of the plant-based meat industry. In 2020, the latter was the leading meat substitute brand in North America with a market share of approximately 23.2%. Beyond Meat was one of the first brands worldwide to successfully develop exquisite and protein-packed products with a taste that is surprisingly similar to that of meat. However, after nearly a decade of dramatic growth, the company’s stock dropped dramatically in the last three months of 2021. Indeed, the world of vegan meat has expanded tremendously in recent years: as the demand for meat alternatives grows, an increasing number of brands – from Impossible Foods and The Vegetarian Butcher to Tofurky and Maple Leaf Foods – are investing in research and development to bring new, innovative and tasty products to the market.

As for plant-based drinks, the Swedish giant Oatly has contributed to making oat milk extremely popular, thanks in past to an extremely successful advertising strategy. Similarly to the plant-based meat industry, however, new competitors have slowly made their way into the market. One of them is Planet Oat, currently the most popular brand of oat milk in the US.

You might also like: Which Plant-Based Milk Is Right For You?