Government subsidies, a financial incentive provided by governments to industries or businesses, are often framed as a positive externality. Advocates claim that, because subsidies externalise some of the costs that would otherwise be paid by consumers for a product or service, the public benefit is a net positive that helps reduce inequality by making industries more competitive and their products more affordable on the market. However, a deeper dive into the nature of subsidisation reveals that the practice can often increase inequality, and when supporting the efforts of unsustainable industries, can hide the superior costs paid by consumers in terms of degrading environmental quality and health standards. The agriculture sector, which attracts over USD$700 billion a year globally in total government subsidies, has proven to be one of the worst offenders in this regard, by distorting the market, prioritising the interests of commercial farms and inflicting substantial damages on the environment and public health.

—

Government subsidies in the agriculture sector are directed towards a variety of industries, including fruits and vegetables, nuts and legumes, and fisheries. By far the largest recipient of government subsidies, however, is the meat and dairy production industry.

The allocation of government subsidies towards agriculture reflects the rising demand for meat and dairy products in the global market. In the US alone, the meat and dairy industry receives 63% of total agriculture subsidies, compared to fruits and vegetables producers who receive only 0.04% of total subsidies.

According to the Food and Agriculture Organization, livestock accounts for 40% of the global value of agricultural production. In industrialised countries, livestock’s share of domestic agricultural land is generally over half. In developing countries, the share is around one third, however the meat and dairy industry is expected to grow substantially over the coming decades due to population growth and the need to meet changing food demands around the world.

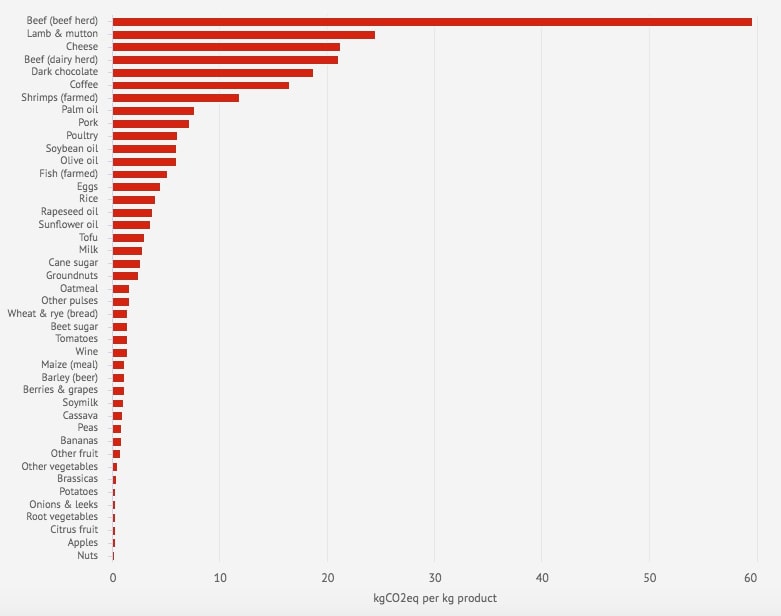

Agriculture, and related impacts from deforestation and land-use changes, is the second-largest contributing sector to global CO2 emissions. Most of these emissions derive from the meat and dairy industry, which contribute around 65% of global agricultural emissions in the form of methane and nitrous oxide releases. The World Resources Institute estimates that animal agriculture accounts for 11% of global emissions. Farming discharge, ammonia gas releases and intensification of fertiliser and pesticide use are, respectively, among the highest contributors to global water, air and soil pollution respectively. The FAO estimates that 33% of global cropland is used to provide feed for livestock, and up to 26% of all terrestrial land has been converted to grazing fields.

You might also like: Paris Court Finds France Guilty of Failing to Meet its Paris Agreement Commitments

Fig. 1: Carbon footprint of different agricultural products; Carbon Brief; 2020.

The environmental costs of the agricultural sector are undeniable. For consumers, however, these costs are not reflected in the market price we pay for agricultural products, especially where meat and dairy is concerned. Partly due to government subsidies, and partly due to other external hidden costs that go into producing and consuming animal products, market prices for these products remain low.

So why do governments provide such extensive financial support to the agricultural sector? Profitability, lifestyle habits and historically entrenched lobbying actors are certainly all culpable. However, considering the impacts that agricultural industries have on the environment, public health and quality of life, it is crucial that governments reallocate their funds to support more sustainable industries while continuing to meet the rising global demand for food.

How to Direct Subsidies Towards Agriculture

Government subsidies towards agriculture can be either direct or indirect. Direct subsidies are often specifically targeted at farmers, through direct payments, crop insurance or low-interest loans. They can often involve the participation of the private sector, especially when a subsidy is meant to provide crop insurance and enlists the services of private insurers.

Indirect agriculture subsidies are more complex. They involve financing sectors or industries that are not strictly related to farming, but are nonetheless critical to a successful agricultural output. Indirect subsidies are rarely counted in total agricultural subsidisation estimates, but play an important role when discussing the environmental and social impacts of government subsidies.

A particularly salient example of external and indirect agricultural subsidies are global water subsidies, which are extremely important to crop farmers. Water, like other natural resources, is becoming progressively more expensive and scarce as global demand grows and climate change affects supply. Cheap and accessible water is clearly a pillar of any stable society, and governments have responded by increasing their water subsidies, which totalled USD$320 billion in 2019.

Indirect subsidies make up a significant portion of the external costs that go into crop and livestock production, and yet they go unaccounted for in tabulations of sector subsidies, further masking the externalised environmental and social impacts. These external costs add up, and despite the claim that subsidies are created to serve the interests of low-income members of society, they tend to only exacerbate existing inequalities through environmental degradation and misallocation of resources.

Agriculture Subsidies and Inequality

How agricultural subsidy funds are allocated is where these programmes become problematic. Only 1% of global agricultural subsidies are directed towards initiatives that benefit the environment and preserve ecological services. The majority of agricultural subsidies go towards deforestation, cattle production and intensifying the use of polluting fertilisers.

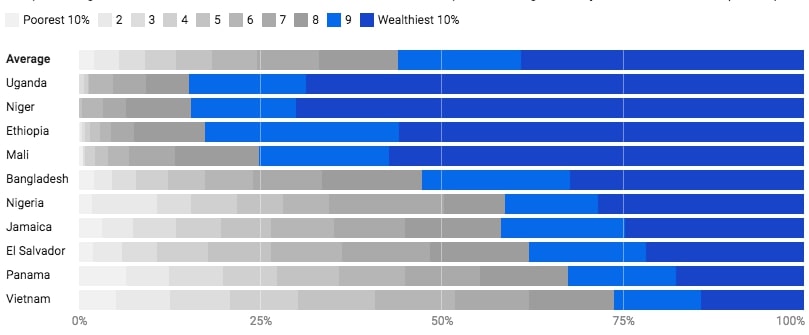

While subsidisation is often framed as a benefit for lower income consumers, the goal of agricultural subsidies is exclusively to make the industry more productive, and the positive social impacts that do exist tend to disproportionately benefit producers and wealthier members of society.

The case of water subsidies is a strong example. Ostensibly meant to support the poor, water subsidies have in reality benefitted the wealthiest multinational corporations and landowners of the agricultural sector, and have damaged the equitable allocation of water resources. Making water cheaply available to farmers has led to overuse, increased water scarcity and widened wealth gaps, as water subsidies provide more benefits to wealthy landowners rather than tenants or small-holder farms.

Fig. 2: Water and sanitation subsidies allocation by household income level across 10 diverse countries. On average, the wealthiest 10% of households receive 39 percent of subsidisation benefits; World Bank; 2019.

Similarly to fossil fuel subsidies, agricultural subsidies tend to benefit the highest spenders in an economy. A 2019 study highlighted this inequality by investigating the divergent ways agricultural subsidies in the form of co-payments benefitted different socio-economic groups in Bhutan. The subsidy provided individual households with agricultural equipment, seeds and, in some cases, machinery. The study found that only 35% of poor households received seed and sapling subsidies, while 52% of wealthy households received seed subsidies and 39% received sapling subsidies. Additionally, co-pay subsidies for more expensive products such as machinery disproportionately benefitted wealthier communities, since low-income households were still required to take out a loan to pay their portion of the co-pay.

Agricultural subsidy programmes are framed as a social tool to benefit smallholder and family farms. However government programmes do not facilitate the efforts of small farms to form coalitions and delegations that can represent their interests before lawmakers. Small farmers therefore tend to hand over their representation to agribusiness lobbies, who despite claiming to fight for small farms, quietly push legislation that supports the interests of corporations and commercial mega-farms.

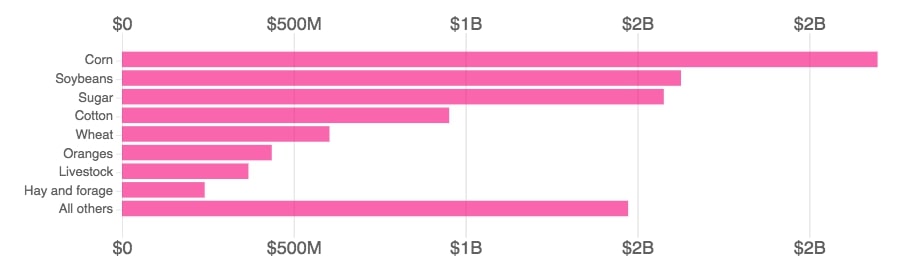

For instance, lobbies have successfully pushed for subsidies that at least partially cover the costs of agricultural machinery, products that are too expensive and often impractical for smallholder or family farms, but are necessary and even economical when spread out over many acres of land and many animals. Additionally, agricultural subsidies tend to support cattle production or long-lasting commodity crops, such as wheat, soybeans, corn, cotton, rice and grains used for animal feed, all favourites of commercial mega-farms. Subsidies are rarely directed towards healthier components of human diets, such as fruits and vegetables.

Fig. 3: 10 most heavily subsidised agricultural commodities in the US in 2016; US Department of Agriculture; 2019.

Incentivising the production and consumption of commodity crops, and withholding subsidies from fruits and vegetables has a direct and detrimental impact on public health. A 2017 study in the US evaluated the effect that various policy measures could have on reducing the rate of cardiovascular disease in the country. The study found that the most effective policy measure in isolation would be to increase subsidies towards fruits and vegetables and reduce their market price by only 10%. Doing so could potentially prevent or postpone up to nearly 160 000 deaths by cardiovascular disease in the US by 2030. The study also found that, if combined with targeted policies based on individuals’ participation in food programmes, a small fruits and vegetables subsidy could reduce disparities in cardiovascular disease death between different socio-economic groups by 6%, potentially increasing the number of lives saved by 2030 to 230 000.

This last study highlights a critical social, financial and health disparity that exists in most countries with agriculture subsidies. Low-income households often cannot afford unsubsidised fruits and vegetables, and instead resort to less healthy, unethically produced and environmentally harmful meat and dairy products. In 2012, fruits and vegetables consumption among low-income individuals in the UK had fallen by 30% compared to 2008 levels, while purchases of mass-produced and processed meats such as bacon had risen significantly. A 2019 study found that, in large urban spaces in the US, the dietary quality of individual households was directly proportionate to income level, as higher income households spent much more on fruits and vegetables, and were only outspent by low-income groups in the purchases of frozen and prepackaged foods.

The Real Cost of Meat and Subsidy Reform

The social disparities imposed by inadequate pricing of healthy versus unhealthy products does not stop at subsidisation. For consumers, meat and dairy products often carry ulterior hidden costs that can dwarf subsidies.

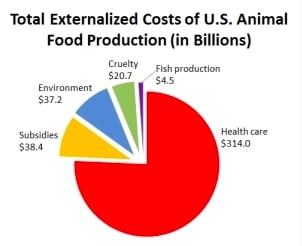

In American lawyer David Robinson Simon’s 2013 book ‘Meatonomics,’ the author estimates that the US meat and dairy industry externalises USD$414 billion annually. This means that animal producers have shifted the vast majority of their costs onto consumers through other, external means. Consumers may not spend a high price for animal products at the supermarket, but taxpayers extensively subsidise the meat and dairy industry by covering the sector’s hidden costs in environmental damages and healthcare costs. Considering taxation costs paid by consumers and subsidies paid by governments, a standard Big Mac hamburger from McDonalds with a market price of $4 actually costs the consumer closer to $12, tripling the cost paid in externalities.

Of the USD$414 billion total, only a small amount comes from government subsidies. The largest meat and dairy externality by far is healthcare costs, which alone account for USD$314 billion. Just like indirect subsidies, these costs are simply taxpayer money going into making meat and dairy products cheaper for the consumer and more profitable for producers.

Fig. 3: Total externalised costs of US animal food production; Meatonomics; 2013.

The externalities of the unsustainable aspects of the agricultural industry are deeply rooted in economic and political conventions, as well as consumer behaviour. To alleviate the costs paid by consumers, improve the community health standards among low-income households and mitigate the environmental impact of the agricultural industries, governments must do what they can to facilitate more sustainable consumer behaviours. This can at least be initiated through subsidy reform.

Any successful subsidy reform in the agricultural sector will need to shift incentives from large corporations to focus on the needs of smallholder and family farms. Current trends in agricultural subsidisation prioritise livestock production and commodity crops grown by commercial farmers, which tend to be the most damaging to environmental quality and community health.

The EU’s current agricultural subsidisation scheme is a good indicator of exactly what countries should not be doing. Essentially, the EU grants more in subsidies the larger a farm is, therefore inevitably providing more benefits to large commercial farms. The EU scheme has been widely criticised for contributing to a decline in the market presence of smallholder farms, and for incentivising monocultures of commodity crops that are easy to scale, but harmful to soil health and inefficient in providing for human needs relative to their environmental impact. Particularly egregious is the fact that subsidies are allocated simply based on the amount of land owned by farmers, and not the amount of land that is actually being utilised to produce goods.

Some EU officials are attempting to push through legislation that would set aside up to 30% of subsidies for farmers who have demonstrated to be moving towards sustainable farming practices such as agroforestry and organic farming, although attempts so far have been unsuccessful. Environmentalists and some countries have criticised the EU for its staticity and lack of ambition in moving away from its current model. The scheme has been so derided in some circles, that British observers who opposed Brexit have vocally welcomed the opportunity for the UK to distance itself from the EU’s agriculture subsidies.

In the long term, governments need to implement alternative economic indicators that are better equipped to reflect the real cost of unsustainable products. In the short term, however, shifting subsidies and making fruits and vegetables more affordable to lower income households can have a substantial effect in adjusting behaviours, by giving consumers more freedom of choice in what to purchase and eat.

Nobody needs to become vegan, but study after study has proven that lowering calorie intake from animal products by even moderate amounts and replacing it with plant-based protein can lower mortality rates substantially by reducing the risk for cardiovascular disease, type-2 diabetes and certain types of cancer. Health risks are exacerbated by cheaply produced processed meats, which the World Health Organisation considers in the same carcinogenic category as asbestos. Adjusting market prices through more targeted subsidisation strategies can make these healthier diets more affordable and accessible to low-income households and individuals, while also minimising the environmental impact of the agricultural sector.

Policymakers have evaluated the possibility of implementing market mechanisms to better reflect the social and environmental cost of meat. On the more extreme end, a meat tax has been discussed in countries with a high rate of meat consumption, although this proposal has been criticised as excessively regressive and restrictive. A more moderate proposal would be to apply carbon taxes to the agricultural sector, which would be able to more accurately reflect the costs of highly emitting meat and dairy producers, and tax these producers accordingly.

While consumer behaviour will need to be adjusted, current subsidisation policies limit options for low-income households, and consumers pay disproportionate costs in external and unaccounted for healthcare costs and environmental losses. By shifting subsidies to support smallholder and family farms, and specifically targeting farms that engage in sustainable farming practices, governments can incentivise innovation, promote equality, mitigate environmental impacts and significantly improve public health standards.