From a toaster in a household kitchen to the turbines of a windmill, steel is everywhere. With a global crude steel production of 1,951 million tonnes in 2021, steel is one of the most used alloys because of its strength, corrosion resistance, and durability. As the world adapts to a rapidly deteriorating climate, this versatile material is now undergoing an extensive transformation. Steel production emits approximately 3.6 billion metric tons of carbon dioxide annually, contributing 7- 9% of greenhouse gas emissions. As the backbone of the modern economy, decarbonising the steelmaking process has become imperative.

—

Why Is Steel Production Emission-Intensive?

The traditional steelmaking process is known as Basic Oxygen Steelmaking. Iron ore, the raw material used for steel, is reduced to pig iron using coke in a blast furnace where temperatures range from 900C to 1,300C (1,600F to 2,300F) depending on the stove design and condition. Traditionally, this hot blast is powered by fossil fuels, mainly coal, and accounts for the bulk of emissions. In fact, about 70% of the world’s primary steel is produced in energy-intensive integrated mills using coal-guzzling blast furnaces.

Pig iron is then re-melted, and oxygen is blown through it to reduce impurities and carbon content. In the process, a large amount of carbon dioxide (CO2) is emitted. One ton of steel results in 1.4 – 1.85 tons of CO2 gas as exhaust.

Alternative Methods

According to the International Energy Agency (IEA), emissions from the steel industry must fall by at least 50% by 2050 and continue to decline towards zero emissions in order to keep on track with global energy and climate goals.

For this purpose, alternative steelmaking processes are being explored. Aside from the electric arc furnace method explained below, all other alternative methods are still in the pilot stage, though the aim is to scale up production to a commercial level before the end of the decade.

1. Electric Arc Furnace

In traditional steelmaking, reducing iron ore into pig iron requires a lot of energy and is responsible for most of the emissions in the process. Electric Arc Furnaces use already reduced material, i.e. scrap steel, and electricity for steel production. Hence, the energy requirements and Carbon emissions are low.

The prerequisites for this method include:

- Clean energy: To reduce the carbon footprint and make the process environmentally friendly, the electricity used to power electric arc furnaces should be carbon-neutral, i.e. powered by renewable energy.

- Scrap steel: Large quantities of scrap steel are required for global steel production to shift to this method. Moreover, the accumulating quality issues with recycled steel reduces its usability for high-grade applications.

The electric arc furnace is the most popular alternative method to the traditional blast furnace and basic oxygen steelmaking.

Currently, about 70% of steel in the US is produced in electric arc furnaces, compared to 30% globally.

2. Molten Oxide Electrolysis

Boston Metal, a US-based startup, is attempting to scale up and commercialise the Molten Oxide Electrolysis (MOE) technology. The MOE cell contains an inert anode immersed in an electrolyte containing iron ore. An electric current applied to the electrolyte reduces the iron to a molten state at 1,600C (2,912F).

MOE is powered by renewable energy and does not use coke or coal, effectively eliminating the energy-intensive reduction process of a blast furnace. With funding of US$262 million from investors like Aramco Ventures, ArcelorMittal SA, and Microsoft’s Climate Innovation Fund, Boston Metal expects to bring MOE to the steel market by 2026.

3. Hydrogen Direct Reductions

This technology uses hydrogen as a reagent to reduce iron ore to the molten state, which is then infused with carbon in an electric arc furnace for the consecutive process steps required for steel production.

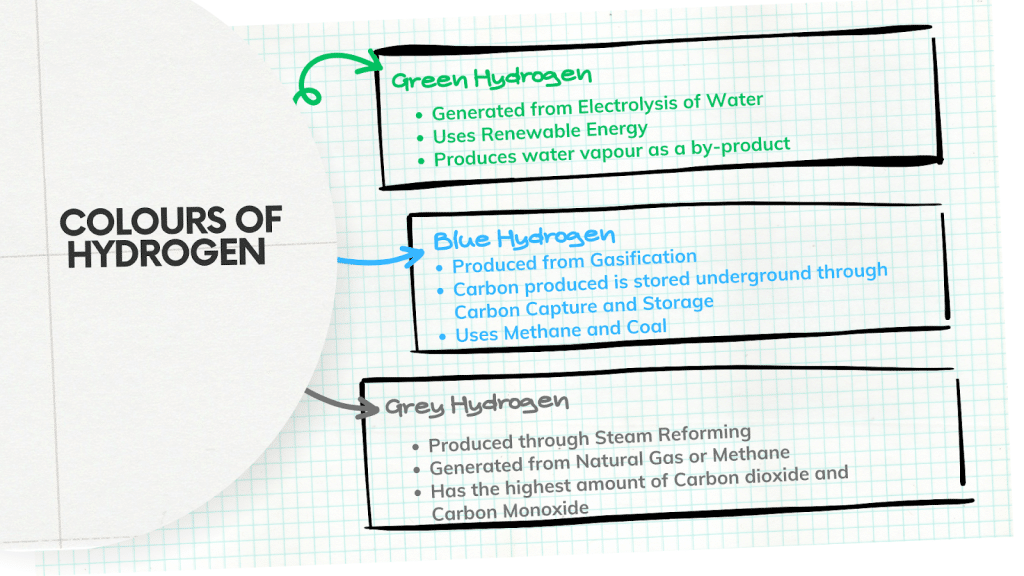

The type of hydrogen determines its carbon footprint. Green hydrogen is produced through electrolysis using electric current to separate water into hydrogen and oxygen, and the byproduct is water vapour.

The electrolysis process is costly and requires a vast amount of electricity. For one ton of crude steel produced from iron ore, green hydrogen generation requires 2,633 kWh of power, and the electric arc furnace plant consumes another 816 kWh. The cost associated with this process is estimated to be 20-30% higher than conventional methods.

Other varieties of hydrogen include blue hydrogen, which comes from captured carbon, and grey hydrogen, which is a byproduct of natural gas and contains a significant amount of carbon.

You might also like: Is Green Hydrogen Energy Viable and Clean?

One point to note here is that since the above-mentioned methods, in contrast with traditional steel production methods, require electricity instead of fossil fuels as energy inputs, the cost structure is subject to different energy markets. Furthermore, while the investment cost in green steel production is currently higher, regulatory measures like implementing a carbon tax could make these alternative methods more preferable in the future.

What Does the Future of Steel Production Look Like?

Several companies are in the pilot stages of hydrogen-powered steelmaking with plans to scale it up.

In August 2021, Hybrit, a joint venture between Swedish steelmaker SSAB, energy supplier Vattenfall and iron-ore producer LKAB, piloted its first customer delivery of hydrogen-reduced steel to Volvo. The company aims to bring the technology to a commercial scale by 2026 and reduce Sweden’s total carbon dioxide emissions by at least 10%.

Another venture, H2 Green Steel, which will be powered by green Hydrogen produced on-site with fossil-free energy, is under construction in Boden, Sweden. As of September 2023, it has raised equity of more than €1.8 billion (US$1.92 billion) and has signed an agreement to supply green steel with automakers Volvo, BMW, Scania and Mercedes Benz, the Ingka Group (IKEA), Roba Metals, Cargill, Bilstein Group, and SPM among others. The plant is expected to start production at the end of 2025 and scale up to 5 million tons by 2030.

ArcelorMittal, ThyssenKrupp, and Salzgitter AG in Germany, Posco in South Korea, and Voestalpine in Austria are also testing hydrogen-powered steelmaking.

You might also like: 5 Ways the Construction Industry Is Getting Greener

Promoting Green Steel

Besides requiring substantial investments in order to scale up alternative technologies, innovators and producers of green steel also face the challenge of low demand signals. In order to connect buyers and sellers and develop a market for the product, several initiatives are being taken.

1. Sustainable Steel Buyers Platform

The Sustainable Steel Buyers Platform (SSBP) was launched during the New York Climate Week held in September 2023. It is a collaboration between RMI, a clean energy non-profit, software giant Microsoft, commercial real estate firm Trammell Crow, and solar technology developer Nextracker.

SSBP aims to close the gap between buyers and sellers of green steel and enable steel demand to be aggregated across both direct and indirect steel purchasers. A request for information has been issued by the participants to North American steelmakers to understand the specifics like quantity, timeline and feasible alternative steelmaking methods. The platform members aim to secure a collective order of 2 million metric tons of green steel.

2. First Movers Coalition

The First Movers Coalition (FMC) was launched at COP26 in Glasgow in 2021. This joint effort by the US State Department and the World Economic Forum (WEF) aims to create early markets for innovative, clean technologies for the net-zero transition. In this coalition, companies use their purchasing power to send clear demand signals for critical emerging technologies. In the first phase, the Coalition will focus on the hard-to-abate sectors like aviation, aluminium, chemicals, concrete, shipping, steel, and trucking, which together account for one-third of global carbon emissions.

Since its inception, FMC has become a US$15 billion demand signal for innovative technologies.

During the 2023 New York Climate Week, FMC partnered with BCG, RMI, Responsible Steel, and Deloitte to launch the Near Zero Steel 2030 Challenge. The main objectives of this initiative are to increase demand signal, trigger commercial scale investment, promote collaboration, and showcase ambition and innovation. The challenge aims to facilitate the beginning of production and distribution of Near-Zero Steel from 2026 onwards.

3. Steel Zero

The non-profit Climate Group and Responsible Steel, a third-party standard and certification initiative for the steel value chain, launched the global initiative Steel Zero in November 2020, which aims to bring together leading organisations to shift global markets and policies towards responsible production and sourcing of steel.

The Road Ahead

The clean tech movement has grown significantly over the last few years. Thanks to policy initiatives like the Inflation Reduction Act (IRA), the Infrastructure and Investments Jobs Act (IIJA), the European Clean Deal, & REPower EU, corporations are inclined to environmentally friendly options.

RMI predicts that green steel demand will reach 6.7 million tons in 2030, owing to an increase in Corporate Sustainability commitments and steel use from 58 companies in the US steel market. While alternate steelmaking technologies are yet to be commercially viable, initiatives like the Sustainable Steel Buyers Platform and First Movers Coalition are crucial in helping promote them by bridging the gap between supply and demand.

The decarbonisation of steel, which forms the building blocks for several industries, will play a vital role in the net zero journey.

You might also like: Built Areas and Infrastructure: Stretching the Boundaries of Sustainability

Featured image: yasin hemmati on Unsplash