COP26 has moved environmental consciousness to the forefront of the priority list of many countries. Let’s explore how the climate crisis conference can impact investing on a global scale.

—

The UN’s COP26 climate summit has seen some 25,000 arrive in Glasgow in early November to tackle the threat of global warming head-on. But what impact will the landmark event have on the world of investing and the stocks held by retail investors?

Figureheads from the world of wealth and asset management will act accordingly to the event panned out. Undoubtedly, the task of managing the carbon footprint of portfolios will be a key consideration across the investment landscape.

With this in mind, let’s take a look at how COP26 has propelled environmental consciousness to the forefront of the priority list, and how this can impact investing on a global scale.

What is COP26?

In a nutshell, the COP26 is the United Nations’ yearly climate conference. Standing for Conference of the Parties, the event is attended by all parties who signed the United Nations Framework, and this is their 26th meeting.

The meeting is a gathering of leaders all around the world who have united with the primary aim of agreeing on actions to tackle the climate crisis.

The 2021 summit was hosted in Glasgow, United Kingdom, and ran from October 31 to November 12 in partnership with Italy.

As the climate crisis intensifies, extra emphasis has been placed on COP26, as an increasing number of governments rally for initiatives to deliver tangible change. Due to the rise of environmental consciousness and this push for more meaningful solutions, the outcome of the event could carry significant ramifications across a wide range of industries – with the world of investment set to be influenced significantly by the discussion points within the event.

Climate Change Likely to be Factored More Heavily into Business Valuations

“The outcome of COP26 is consequential for long-term investors given the rise in sustainable investing,” Meera Pandit, global market strategist, J.P. Morgan Asset Management, explained to Axios.

Should COP26 pave the way for all members to achieve their goals, the feat will come with many different impacts on the investing landscape. The increase in the quantity and quality of climate-related disclosures will lead to more objective scrutiny over an investment’s environmental footprint.

Daniel Boyd, investment analyst at IMX, notes that “the centralisation of climate-related scenario analysis should, in theory, lead to climate risk being priced into valuations more accurately and quickly. It will also provide managers and advisers with better tools to identify and manage climate risks.”

In response to the policies introduced and accelerated due to COP26, industries and companies that generate low emissions and those with a functional net-zero transition plan should see significant levels of growth in size and valuation as a result. Furthermore, the impact on returns will lead to more shareholder activism and increasing volumes of stewardship as stakeholders learn that encouraging companies to make the transition could come with a healthy financial reward.

Maxim Manturov, head of investment research for Freedom Finance Europe, warns that the fallout of COP26 may cause some stocks to experience periods of volatility as investors and institutions begin to interpret the policies that emerge from the event. “Before making any investments, new investors need to know their risk tolerance. Some investments carry more risk than others, so it’s worth thinking about preserving capital first,” Manturov warned.

You might also like: The Case for Green Quantitative Easing: A New Green Monetary Policy

Changes Likely to be Felt Across Emerging Markets

Jonathan Fletcher, head of EM Sustainability Research told Schroders that he believes emerging markets sustainability investments will feel the benefits from the outcome of COP26.

“I’m really optimistic with regards to COP26, and the opportunity this brings to address the world’s climate challenges. As an investor in emerging markets, I’m all too aware of the impact of climate change. Of the top ten cities most vulnerable to climate change, nine are in emerging market countries. Air quality is a concern across many emerging countries. Of the top 50 cities ranked by highest air pollution, 45 are in EM. The need for coordinated action, and financial support to help these countries, is absolutely fundamental,” Fletcher said.

“Many of the companies which we invest in within emerging markets are facilitators of positive environmental impact. It is one of five key themes in our investment process. And while investors, together with the public companies in which they invest, can have a critical role, coordination with government, as well as coordination between governments, is also essential.”

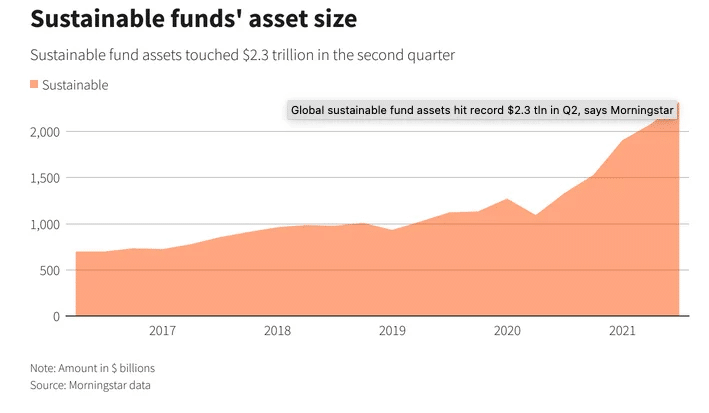

As we can see from the data above, sustainable funds asset sizes reached new levels in 2021 as environmental awareness continued to grow in the wake of the disruption caused by the COVID-19 pandemic.

With a record USD$2.3 trillion in sustainable fund assets being reached in Q2 of 2021, it’s reasonable to expect that the outcome of COP will accelerate this growing trend further, providing more choice for eco-friendly investors.

The Reinvention of Fossil Fuel Companies

We’re also seeing evidence of traditional fossil fuel companies being reinvented to meet ambitious targets on carbon neutrality. For instance, BP was met with bemusement when the petroleum company announced that it intended to go net-zero by 2050, but it stands as an example that non-ESG compliant companies can still work to deliver positive change.

Likewise, Shell has pledged to sell its US shale assets. These transitions towards more carbon neutrality may offer a saving grace for investors and provide growth potential as the emphasis on sustainability becomes greater in the coming months and years.

The rise of environmental consciousness and the outcome of COP26 will carry immeasurable significance across the world, but it will also open up a range of investment opportunities – particularly within sustainable practices in emerging markets. Whilst environmental initiatives can be troublesome for non-ESG compliant companies, they may well deliver a prosperous environment for stocks and shares to flourish, and act as a catalyst for long-term growth.