In November 2019, the activist hedge fund TCI Fund Management released their Environmental, Social and Governance (ESG) Investment Policy statement on publicly traded equities in a push for disclosure of greenhouse gas (GHG) emissions and low-carbon transition plans. TCI believes its activist investor approach facilitates more sustainable business procedures, while reducing exposure of investments to climate change-related risks. Could these measures prompt wider climate action in the finance industry?

—

Over the past decade, major controversies like the Volkswagen emissions scandal or BP Deepwater Horizon spill were followed by significant declines in stock prices, alerting investors and the public on the importance of considering the societal and environmental impacts of these companies beyond their short-term profits. ESG consideration has hence begun to take off, fuelled by the desire of investors to reduce volatility of returns by mitigating climate and reputational risks, alongside humanitarian considerations of financing improvements in society. From a niche term in the finance industry, ESG has grown to form the basis of the UK’s new Green Finance Strategy, mandating that publicly listed companies and large asset owners must disclose how their operations are affected by climate change risk by 2022, with the wider goal of reducing GHG emissions to net zero by 2050.

However, the Green Finance Strategy has been criticised as being ‘too little and too late’. This sentiment was shared by private-sector representatives such as TCI Managing Partner and Portfolio Manager Sir Christopher Hohn, who believes that investors should play a leading role in forcing GHG emissions disclosure, given that government policies are not far-reaching enough.

True to these views, TCI released its updated ESG Investment Policy in late 2019, asserting that it will vote against all directors of companies which lack both a public disclosure of GHG emissions and credible plans for their reduction, as well as auditors whose Annual Report and Accounts fail to report material climate risks. By exerting pressure on its portfolio companies to adopt more environmentally-friendly business operations, TCI aims to reduce their susceptibility to climate change-related risks arising from future regulatory, litigation or physical asset impairment costs, while preserving long-term brand reputation and competitiveness. TCI currently manages more than $28 billion in assets.

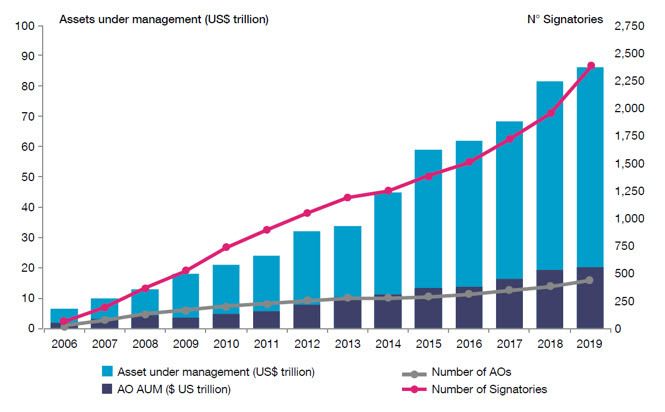

The total value of global sustainable investments in 2018 stood at US$ 30.7 trillion- growth of 34% over two years- which is a little under the combined GDP for the US and China at the time.

As per a report by the Global Sustainable Investment Alliance (GSIA), Europe has the highest value of sustainable investing assets, with nearly half of the total global assets from the region, closely followed by the US. Additionally, green funds are now bearing improved returns from a decade ago, when a 2012 study concluded that they ‘underperformed on a risk-adjusted basis’ compared to traditional funds.

While TCI’s actions mark the latest steps forward for ESG amongst investment firms, much more work remains to be done. Notably, Hohn has criticised BlackRock– the world’s largest asset manager- of ‘greenwashing’ (making an unsubstantiated or misleading claim about the environmental benefits of a product, service, technology or company practice), as it does not mandate GHG emissions disclosures from portfolio companies. Without discounting TCI’s efforts, a wider paradigm shift in the finance industry remains necessary to effectively combat the ensuing climate crisis.