The green bond movement has been going strong for over a decade. Since the green bond market first opened in 2007, more than USD$1 trillion worth of green bonds have been issued globally as investors have started to see a sustainable future as a profitable one. You’d think a global pandemic – that has led to the loss of 400 million full-time jobs and the worst stock market crash since 1987 – would halt it in its tracks. However, green bonds have defied the odds. Since the beginning of 2020, a total of 366 green bonds issuances have been launched globally, with a total of $168.2 billion raised by companies, financial institutions and governments, according to a new analysis by global law firm Linklaters. With the door open for the next green bonds hub to emerge, Hong Kong might be the first one through.

—

Admittedly, its growth rate is expected to slow – particularly in the APAC region where China’s green bond issuing market experienced a 63% dip from 2019 to 2020 – due to investors’ shift towards social bonds that sustain projects addressing COVID-19 (i.e. investment in public healthcare). However, this doesn’t change the fact that green bonds – capturing debt capital in the market to finance sustainable projects – are highly capable of transforming the global economy by driving long-term growth and enabling long-term environmental sustainability.

Oversubscription – where demand has exceeded the number of green bonds available – has become the norm for green bond issuances, due to its expected market growth as sustained investment in climate projects (estimated to reach $90 trillion by 2030) increases as part of nations’ efforts to achieve carbon reduction targets set in the Paris Agreement. In other words, with climate change firmly on the global agenda, the use of green bonds will continue to be an active instrument for governments and private sectors to consistently invest in eco-friendly projects ranging from energy efficiency and pollution prevention to clean transportation and implementation of new green technologies.

However, to further advance the green agenda, the green bonds market necessitates a hub that can facilitate its global transactions across a diverse set of investor markets.

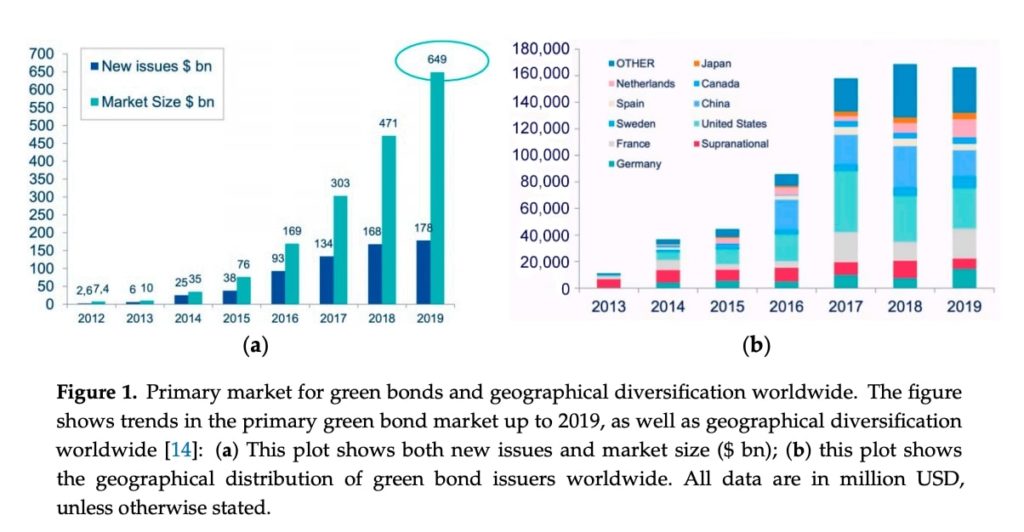

Figure 1. Primary market for green bonds and geographical diversification worldwide

(Alonso-Conde and Rojo-Suarez, 2020)

The above indicates trends in the primary green bond market up to 2019, as well as geographical diversification worldwide, where (a) shows both new issues and market size ($billion), while (b) shows the geographical distribution of green bond issuers world (currency in USD). There is a notable increase both in terms of the expansion of the green bond market as well as the diversification across various regions spanning Europe, North America and Asia. With a rapidly expanding investor base, it becomes important to establish a platform capable of accommodating investors’ diverse set of needs and requirements.

What better place to create a green international finance centre than Hong Kong, an already-international financial one?

You might also like: Joe Biden is US President-Elect, But What Would a Republican Senate Mean for the Climate?

Hong Kong at night.

Hong Kong is set on becoming the future hub for green finance. In August 2020 during his budget speech, Financial Secretary Paul Chan announced that the HK government would be issuing HKD$66 billion (USD$8.5 billion) in green bonds in the coming 5 years. That is a staggering amount, considering the fact that between 2016 – when the city issued its first green bond – and 2019, the city’s total green bond issuance stood at a mere USD$7.1 billion of a USD$672.4 billion global green bonds market, according to Climate Bonds Initiative.

Widespread acceptance of green bonds in Hong Kong hasn’t happened quickly. In fact, Hong Kong has launched several initiatives for the past few years to advocate for the green bonds cause.

From launching a green bond scheme in November 2018 with a borrowing ceiling of HKD$100 billion (the first issuance of sovereign green bonds across Asia) that would attract domestic and overseas entities from both public and private sectors, and becoming the first signatory in Asia of the Green Bond Pledge in 2019 (in support of green bond issuances for infrastructure), to establishing increasing levels of internationally compatible certification and disclosure standards for its green bond issuances, Hong Kong has made its intentions clear: it wants to become a leader of green bonds in the APAC region and a key role model for the region moving forward.

Other countries aren’t far behind. For instance, Malaysia is set to become the first emerging market country to introduce a green principle-based taxonomy for banks to help tackle climate-related risks. On the other hand, Hong Kong’s “rival” Singapore has already unveiled an ambitious action plan which includes a green investment programme for asset managers that aims to foster a strong foundation for green bond trading. With investor demand for green products projected to remain robust moving forward, a lot of other markets in the region will also be competing to become the next leading green finance hub. Needless to say, Hong Kong will have its hands full for the coming years.

So what exactly makes it stand out more across its other competitors? One reason is its unique political and regional location in connection to the Greater Bay Area (GBA). Located at the heart of Asia, Hong Kong thrives as an extensively networked, financial integrated centre predicated on a sound legal system, low and simple tax regime, free flow of capital, full range of financial products and a large pool of financial talents. But it is also the fact that Hong Kong has close financial integration with Mainland China that provides an indication of its future green success. With its strong ties to China, Hong Kong in the past few decades has essentially acted as an intermediary between China and the international community.

Despite recent political turmoil, Hong Kong remains a strong bridge to China primarily due its compatibility with the Belt and Road Initiative. Infrastructure construction is a major component of the Belt and Road Initiative. Appropriately, green bonds are ideal instruments for financing the construction of sustainable infrastructure, given its characteristics of sizable financing amount with long maturity, and taking into account the protection of ecosystem and livelihood. With its ideal geographical location within the Greater Bay Area, Hong Kong has a great potential for attracting green bond issuance to support infrastructure projects along the Belt and Road, which would be beneficial to market development in the long run.

As it stands, the Hong Kong Stock Exchange is Asia’s third-largest capital market and has been the top initial public offerings market in seven of the past 11 years. Projects in the Greater Bay Area, which comprises Hong Kong, Macau and nine mainland cities, can use Hong Kong to tap funds for green projects, such as making buildings more energy efficient and mitigating flood risks arising from climate change. Furthermore, attractions for mainland firms issuing green bonds in Hong Kong include lower dollar and euro financing costs and more flexibility in timing and size of issuance. Additionally, with mainland authorities relaxing policies to allow green bond issuers to convert foreign-currency proceeds into yuan and remit them to the mainland when they wish, this facilitates even greater convenience that may lead to rapid transactions between HK and the Greater Bay Area. Under these robust circumstances, as one of the most competitive financial systems globally, Hong Kong has the opportunity to capitalise on its robust institutional environment and strategic location in Asia to establish its position as a financial hub capable of meeting green investment needs across the region.

Of course, there are still many steps that need to be taken before we begin proclaiming Hong Kong’s ascension to the green finance throne. For Hong Kong to attain this status, it will be critical for the government to build a policy framework and taxonomy that clearly outlines what activities are considered as sustainable actions. As of now, there is no industry-wide standard that justifies all investments, which can lead to greenwashing. It also results in supply becoming lower than demand in the green bond space due to a lack of clarity on project eligibility for some sectors, among other problems. While some work has been done by the Hong Kong Quality Assurance Agency (HKQAA) and the Securities and Futures Commission (SFC) on what constitutes as a green investment, most of these standards remain fragmented and voluntary which leaves room for organisational exemption. It will be the Hong Kong government’s responsibility to push through a global standard for green bonds that is sustainably acceptable and can increase the supply of sustainable bonds over time. The HKEX’s mandatory disclosure standards for corporations, effective as of July 1 2020, and its decision to create Asia’s first sustainable financial information platform – named STAGE – is a good start. Further, to push through these changes from an operations standpoint, the government will have to consider allocating more funds to green asset managers to help them grow, either through the Hong Kong Monetary Authority’s Exchange Fund or provident funds.

The fight for the most viable green hub will be a tight and fiercely contested battle across the APAC region. But if Hong Kong is able to maintain its status as a financial hub, while extending its regulations so that it is compatible with both the GBA and the EU taxonomy, it might have the greatest chance in advancing the green bond agenda of the future.