It sure looks like Norway is leading the world on climate. The Scandinavian country boasts the highest rate of electric vehicle sales, the highest share of renewable energy usage and is home to some of the most splendid and breathtaking natural wonders on the planet. But underneath the nation’s impressive accomplishments hides a not-so-secret truth: the oil industry in Norway is one of the world’s leading fossil fuel and emissions exporters. In 2019, petroleum and gas accounted for 48.1% of Norway’s export revenues, around USD$52.6 billion. Norway’s paradox is unique; the country has created an equal, peaceful and prosperous society, but has paid for much of it with immense fossil fuel revenues. As the world staggeredly moves away from oil and gas, will Norway be able to resolve its paradox?

—

The Kingdom of Norway, home to merely 5 million people, possesses a prosperous GDP per capita of USD$75,000 (ranking 11th highest in the world) and tops the world’s Human Development Index, an assessment of a country’s developmental state and human wellbeing. But Norway’s prosperity is in no small part due to revenues from its lucrative fossil fuel industry.

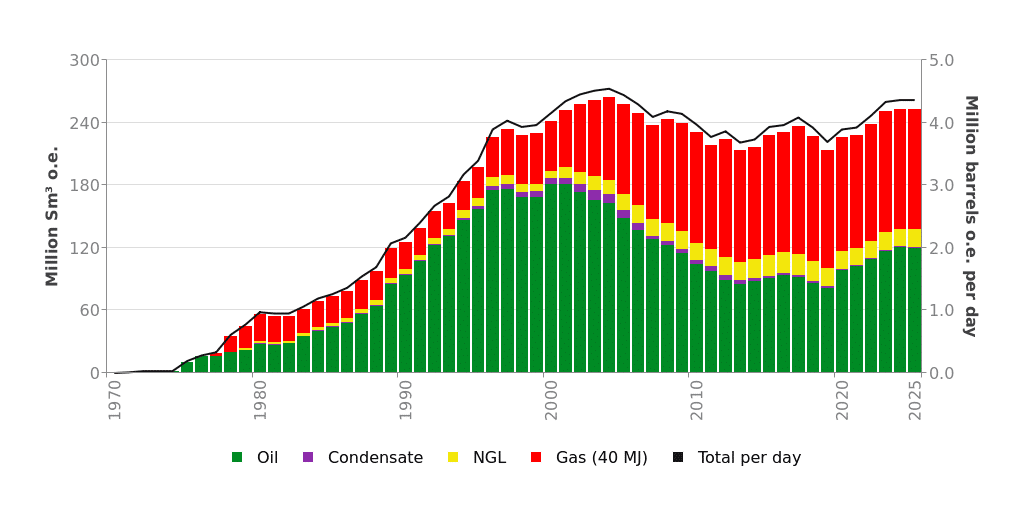

Since fossil fuels were first discovered and extracted from the Norwegian continental shelf more than five decades ago, the flourishing petroleum industry has become a lucrative national income for Norway. Equinor, a state-owned petroleum company that fully or partly owns 50 oil fields, representing how committed the government is to fossil fuel production, as the state currently holds 67% of total shares. As of 2020, Norway extracted 226.5 million cubic metres of oil equivalents (Sm³) of marketable oil equivalents and the total sales of gas is 112.3 billion Sm³.

The government realises that its oil reserves won’t last forever, and so Norway invested a large portion of the surplus revenue from its petroleum sector to the Government Pension Fund Global for future generations. This is the largest sovereign wealth fund in the world, worth USD$1.3 trillion in assets in 2019. Norway’s experience can be a successful case study for a sustainable future, yet exports from oil industry in Norway incur a series of paradoxes and errors in judgement. How can Norway deal with this issue?

Has the Oil Industry Corrupted Norway?

In countries where oil has fuelled economic growth, such as several in the Middle East, the commodity has led to high rates of corruption and autocratic rule. But even though Norway enjoys a lucrative oil industry, the country has stayed free of corruption, and justice and equality are safeguarded.

Norway’s Gini coefficient was 0.27 in 2018 and at least 90% of citizens expressed satisfaction with public services (police, healthcare, education and judiciary) in 2020. This data, which measures income inequality within a nation, demonstrates a high mutual trust between Norwegian citizens and their government. In other words, any form of corruption and an unfair decision would be revealed, condemned and punished by the public and an effective judicial system.

Norway has ingrained egalitarian ideals and is also a welfare state. Most Norwegian citizens believe in an equal distribution of wealth and opportunities, and the government has major responsibility for welfare distribution among its citizens. For example, Norway has one of the best healthcare and education systems in the world, and the government invests heavily in the quality of these services. Thus, Norway’s Happy Planet Index ranked 12th out of 140 countries in 2021. When the state provides effective social security nets for every citizen, happiness tends to be higher and inequality tends to be lower because mental and physical needs have been comprehensively fulfilled. More material desires would not impact their simple and modest lifestyle.

The Government Pension Fund of Norway has a significant impact on national happiness because this sustainable investment provides an extra and firm social safety net for all Norwegian citizens. The return interest is based on a series of ethical investment criteria. For instance, the Fund should avoid and exclude all unethical arms companies from its investment portfolio and respect human rights in all circumstances.

What’s more, any companies engaged with “serious or systematic human rights violations”, “severe environmental damage” or “acts or omissions that on an aggregate company level lead to unacceptable greenhouse gas emissions,” should not be invested in in any case so as to follow the UN Global Compact, the OECD’s Principles of Corporate Governance and the OECD Guidelines for Multinational’s Enterprises. In brief, the Fund demonstrates a full profile of corporate social responsibility to uphold its ethical principles.

Norway’s Paradox: Oil Industry Exports and a Green Society

Domestically, the Norwegian government has pursued comprehensive environmental protection laws, but their ongoing oil exports indirectly pollutes the rest of the world, making their net-zero target debatable. As of 2018, renewable energy made up 60.8% of Norway’s total energy share and hydro/marine power accounted for 85% of the mix of renewable energy. Since Norway benefits from a long coastline, the development of wind-power capacity rose from 704 megawatts in 2012 to nearly 4,000 megawatts in 2020. This full-fledged clean energy infrastructure is a cornerstone behind the 500,000 electric vehicles on Norway’s streets.

Norway’s cutting-edge technological expertise also contributes to their carbon capture and storage infrastructures to store carbon deep underground within reservoirs on the Norwegian continental shelf. The capacity can capture 400,000 tonnes of CO2 annually, which is equivalent to approximately 60,000 fossil fuel vehicles per year. But while Norway has put huge efforts into protecting its domestic environment, its continued reliance on fossil fuel exports represents a moral contradiction.

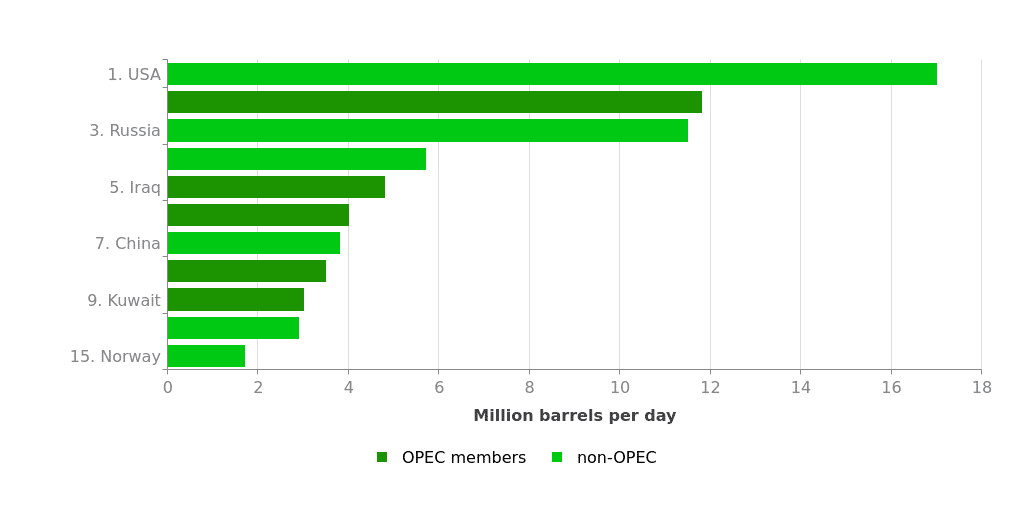

Norway has a predominant role in foreign exports of crude oil and natural gas. In the same year, Norway exported approximately 66 million standard cubic meters (Sm³) of crude oil directly to other European countries, 12.5 million Sm³ was delivered to onshore facilities in Norway and 15.1 million Sm³ of crude oil was delivered to China. Although Norway’s oil production represents only 2% of global oil demand (Saudi Arabia and Russia account for 24% altogether and the US accounts for 18% of the global oil production), they still play a major role in greenhouse gas emissions.

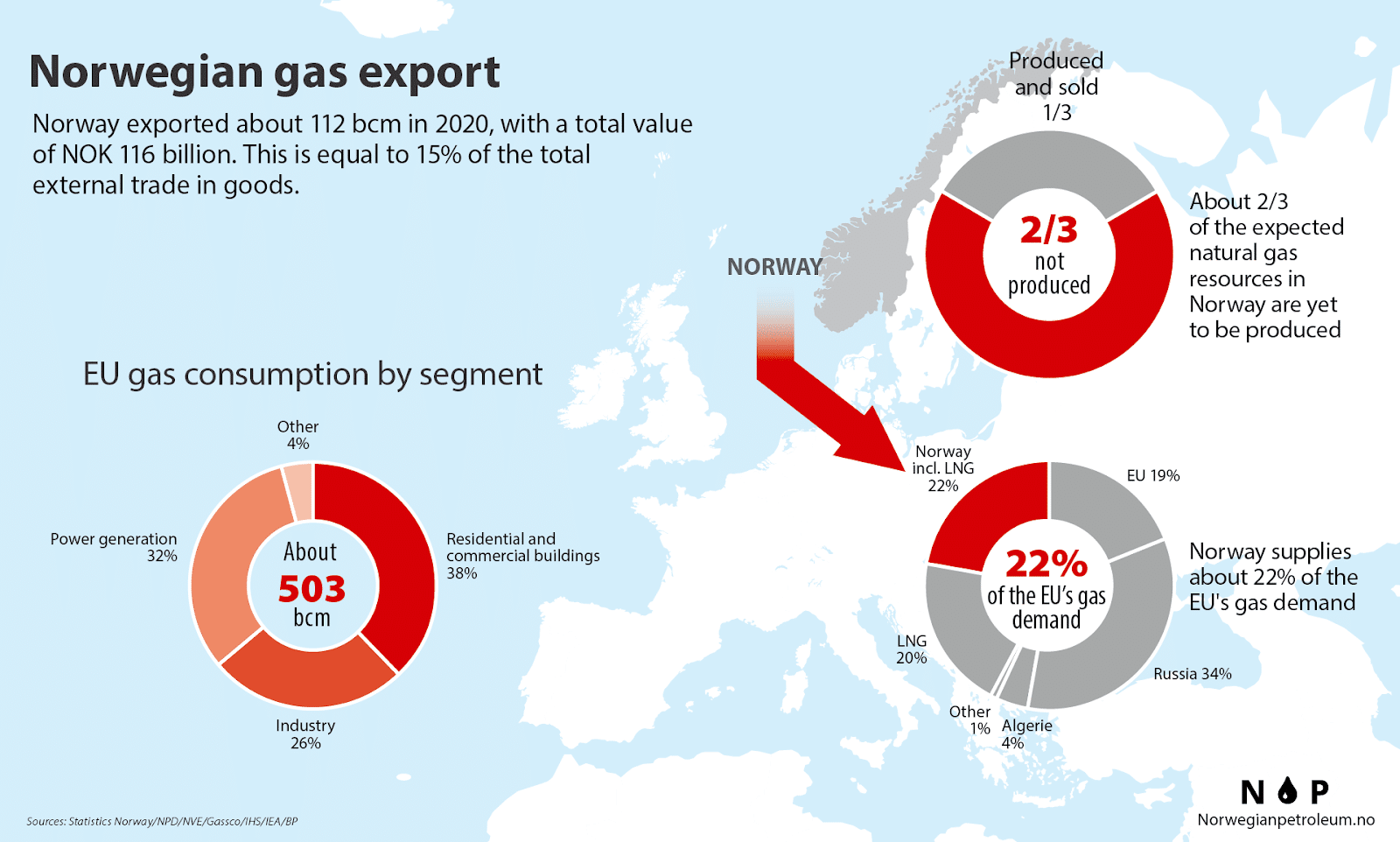

Norway also exports 114 billion cubic meters to cover approximately 3% of global demand, the third-largest exporter of natural gas in the world. As most EU countries massively rely on natural gas for civil, commercial and industrial use, Norway’s 112 billion Sm³ of export fills up around 20-25% of the EU’s gas demand and safeguard the EU’s energy security.

Based on domestic use of renewable energy and foreign exports above, this creates a moral contradiction: the country’s domestic effort to decarbonise and its persisting oil export industry in Norway is effectively a contradiction, and largely undermines the EU’s larger efforts to decarbonise. As it’s a tall order to dismantle the petroleum industry that accounts for around 40% of Norway’s exports and 14% of its gross domestic product, Norway should have a long term policy in mind to gradually lower the total amount of production, extraction and foreign export in the following decades. But conversely, the Norwegian government plans to offer more official licences for fossil fuel exploration in the Arctic region to “facilitate long-term economic growth in the petroleum industry”.

Norway is planning on increasing its fossil fuel exports over the coming years instead of drawing them down, at the exact worst moment. While maintaining their foreign export revenue and turning a blind eye to the global consequences of greenhouse gas emissions, Norway’s actions could impede the efforts of the EU and China to accomplish their own NDC commitments and reach net-zero. Norway has made domestic efforts to decarbonise through electric vehicles, carbon capture facilities and use of renewable energy, but their continued reliance on fossil fuel exports hinders the global effort to reach net-zero.

You might also like: Will Greenland Ditching Oil Reshape Arctic Climate Politics?

Norway’s Paradox: Environmental Protection & Environmental Concern

Norway is the first country to ban deforestation and prohibit products that violate said ban. In 2016, the government declared that there will be no business contracts with private sectors with a past record of deforestation. What’s more, around 17% of the Norwegian mainland and 65% of the Barents Sea is currently protected by national parks, reserves or other conservation designations. Norway’s Ministry of Climate and Environment has published an official ocean policy to promote the Law of the Sea, conservation and sustainable use of marine ecosystems and contribute to knowledge-based management. It is because the ecosystem of the Barents Sea is suffering from rising sea levels and temperatures. In short, Norway has actively promoted environmental protection within their country but ongoing oil extraction and foreign export remain a high environmental concern.

In October 2021, Varr Energy, the Norwegian oil and gas exploration and production company, announced the discoveries of new oil and gas fields in the Southern Barents Sea and an estimated 9-12 million barrels of recoverable oil equivalents. What’s more, Norway has announced no less than six new oil discoveries this year so far.

Norway has also promised European countries to increase natural gas exports to ease the high pricing situation in recent months. As of August 2021, the crude oil West Texas Intermediate (WTI) price was around $62 and it soared by 33% to around $83-$85 in late October 2021. The Brent crude oil price experienced a similar rate of increase in the same timeframe. In this sense, a high natural gas price and high demand imply a new wave of financial benefit for Norway whereas an energy crisis for the rest of European countries. Although Norway’s increasing supply can alleviate the imminent energy shortage, further oil exploration and extraction will eventually exacerbate the greenhouse effect. As such, Norway should have a detailed adaptation plan and cooperate with foreign countries and institutions to balance global environmental protection measures and gradually draw down its oil extraction.

Norway’s Green Future

Norway’s sovereign wealth fund plans to take substantial actions to tackle climate change in the near future. Since oil and gas exploitation and financial returns create a financial safety net for all Norwegians, the fund has realised that they should be paying some of it back to the world. The fund has urged invested companies to disclose the material impacts of activities, products and services on biodiversity and ecosystems. They have also urged companies to assess their direct and indirect impacts on the surrounding environment.

Nicolai Tangen, CEO of Norges Bank Investment Management once stressed that “an increasing loss of species and deterioration of ecosystems can affect companies’ ability to create value for investors in the long term.” For example, the fund urged fossil fuel company Exxon to raise its corporate transparency to prevent any form of lobbying on climate policies. In short, the fund has influential powers that can alter companies’ behaviour and strengthen the market’s willingness to safeguard our environment.

In 2019, the fund announced investments worth billions of dollars into wind and solar power projects. This historic decision can undoubtedly accelerate the global effort to achieve full-scale renewable energy to combat climate change. In fact, the fund can actually diversify their investment portfolio to secure a greener future profit based on the growth of clean energy companies. As the sum of the investable fund in green projects has been doubled to $14 billion dollars, Jan Eric Saugestad, CEO of Storebrand Asset Management, said that it’s a good sign to invest for the future generation.

In March 2019, the fund announced that they would no longer invest in at least 130 companies that relate to oil and natural gas. In contrast, the fund is investing in several renewable energy projects that have not been listed on stock markets. Unlisted projects account for more than two thirds of the whole renewable infrastructure market. These actions demonstrate the fund’s willingness to safeguard the country’s energy future despite revenues earned by exports from the oil industry in Norway.

If Norway’s fund can become a pioneer of carbon neutrality, then other sovereign funds, which are estimated at $10 trillion, will follow in its footsteps to achieve carbon neutrality and comply with a global trend leaning towards green energy investments. Due to its sheer size, Norway’s wealth fund could be a catalyst in achieving sufficient global investments towards a green future.

But Norway’s move to divest from fossil fuels and pursue a green future would mean little if it aims to continue expanding and profiting from its domestic fossil fuel industry. In an eminently contradictory decision, the nation even plans to use land-based renewable hydropower to electrify its offshore oil and gas extraction plants. ‘Green oil’ does not exist, and to fully ensure that Norway and its neighbours can reach a sustainable future, long-term policies must be put in place to draw down the country’s fossil fuel industry.

Featured image by: Pixabay