Carbon taxes around the world have been implemented to compensate for the amount of greenhouse gas emissions countries and industries have produced and released to the Earth’s atmosphere. Earth.Org takes a look at what countries have a carbon tax and other financial mechanisms as a tool to incentivise parties to reduce harmful emissions and pollution.

—

According to the recent International Panel of Climate Change (IPCC) report, the world is well on its way of reaching a 1.5 degrees Celsius temperature increase by 2040. To slow global warming, many developed and developing countries have pledged to reach net zero emissions by 2050. Governments are achieving this by regulating emissions output and encouraging a widespread transition towards electric transportation. Financial incentives and economic mechanisms including carbon pricing have also progressively play larger roles in reducing global emissions.

What Is a Carbon Tax and Emissions Trading Scheme?

One of the largest financial tools to combat climate change is a carbon tax. A carbon tax is imposed by a government to put a direct price on greenhouse gas emissions (per tonne) produced by companies or industries. It works an economic incentive for polluters to lower emissions or switch to more efficient processes or cleaner fuels.

Other economic mechanisms such as a cap-and-trade system or emissions trading scheme (ETS) can be imposed in place of a carbon tax, where governments would cap the amount of greenhouse gas emissions released into the atmosphere every year based on carbon credits. Emitting industries and companies will have the ability to sell their extra allowances to larger polluters, creating a market for carbon. This mechanism aims to deter large emitting companies from exceeding their pre-allocated carbon budget, and reduce overall emissions as a result.

However, these financial incentives might not be enough to deter industries to reduce carbon emissions. Many have suggested adopting a carbon border tax, which would apply a charge on imported goods produced in countries with weaker emissions regulations. A cross border carbon tax would help make industries and businesses in countries that have higher carbon prices competitive against oversea businesses.

You might also like: Carbon Tax: A Shared Global Responsibility For Carbon Emissions

Carbon Tax Countries

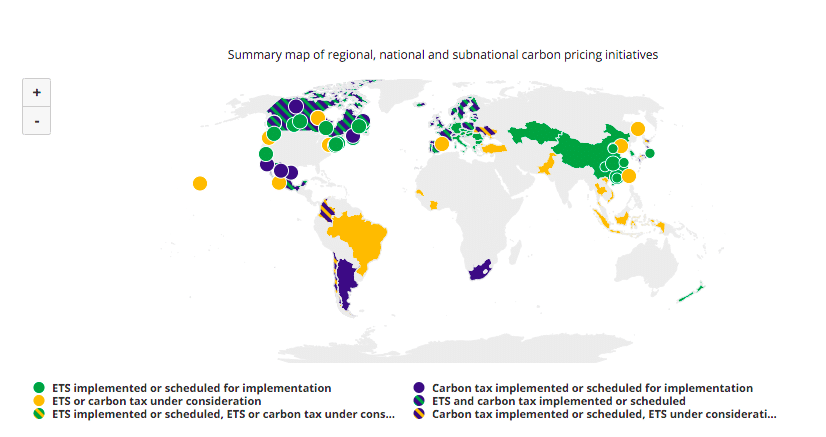

There are currently 27 countries with a carbon tax implemented: Argentina, Canada, Chile, China, Colombia, Denmark, the European Union (27 countries), Japan, Kazakhstan, Korea, Mexico, New Zealand, Norway, Singapore, South Africa, Sweden, the UK, and Ukraine. Other countries that are considering joining them include Brazil, Brunei, Indonesia, Pakistan, Russia, Serbia, Thailand, Turkey, and Vietnam.

Furthermore, there are 64 carbon pricing initiatives currently in force across the globe on various regional, national, and subnational levels, with three more scheduled for implementation, according to The World Bank. Together, these initiatives have been estimated to cover 21.5% of global greenhouse gas emissions in 2021.

EU Carbon Tax

The European Union has one of the best examples of a cap-and-trade system, called the EU Emissions Trading System. Importers of emissions-intensive goods have to pay a charge based on what producers would have had to pay under EU carbon emission regulations. As of September 2021, the price of carbon per tonne in the EU programme is at 62.45 Euros, and continues to rise.

In the ambitious legislative package announced in July 2021 as part of the EU Green Deal, the European Commission is adopting policies to expand the bloc’s existing ETS to other sectors including aviation and maritime.

But most notably, the legislative bundle proposes the world’s first carbon border tax, also known as a carbon border adjustment mechanism. The cross border carbon tax will place a levy on imports of materials including steel, aluminium and fertiliser from nations and foreign companies with laxer environmental rules. The bloc hopes to protect local businesses in countries subject to emissions-reducing regulations by charging goods and materials imported from carbon intensive businesses and countries. However, a penalty system has yet to be determined and many EU trading partners including Russia criticised the proposal, claiming that they could potentially lose up to USD$7.6 billion from it.

Carbon Tax in China

China recently launched its national emissions trading scheme, making it the world’s largest carbon market. On the first day of its opening on July 16, the market saw 4.1 million tonnes of carbon dioxide quotas worth USD$32 millions traded. The country will likely push for more market-based mechanisms to help lower carbon emissions and to help reach its zero emission target by 2060.

You might also like: Cap-and Trade vs Carbon Tax

Lack of Emissions Trading System in the US

One of the most glaring absences from the list is the US, especially considering they are one of the world’s largest carbon emitters. While President Joe Biden has made a significant push for his clean energy agenda since stepping into office – he pledged to slash US emissions by 50% by 2030, reach zero emissions by 2050, and signed an executive order to make 50% of all new US cars electric by 2030 – he has notably failed to include any carbon pricing initiatives or schemes in his clean energy plan. Democrats’ proposal of adopting a carbon border tax was largely ignored by the White House.

This could be linked to the fact that when the Obama administration proposed a national carbon tax or a cap-and-trade scheme to help reduce carbon emissions, it received monumental backlash from US Congress including a non-binding measure denouncing a carbon tax by Congressional Republicans in 2016. At the moment, only a few subnational carbon initiatives are implemented in the US, namely a cap-and-trade programme in California and an ETS in Massachusetts.

This story is funded by readers like you

Our non-profit newsroom provides climate coverage free of charge and advertising. Your one-off or monthly donations play a crucial role in supporting our operations, expanding our reach, and maintaining our editorial independence.

About EO | Mission Statement | Impact & Reach | Write for us